1339681v1-THE EFFECTIVENESS OF FISCAL PO.DOC November 21, 2001 (1:46 PM)

The Effectiveness of Fiscal Policy in Stimulating Economic Activity

An Empirical Investigation

Emanuele Baldacci, Marco Cangiano, Selma Mahfouz, and Axel Schimmelpfennig

1

November 2001

Preliminary draft. Comments welcome

Abstract

Recent years have seen a revival of the debate about the role of fiscal policy in stimulating economic

activity. The empirical literature suggests that fiscal multipliers are typically positive but small, and

while there is some evidence of negative fiscal multipliers, there is no clear consensus on the

preconditions for such an outcome. However, most of the empirical evidence is for advanced

economies and the effectiveness of fiscal policy in emerging market economies, countries in

transition, and developing countries remains largely undocumented. This paper tries to fill this gap by

using data for a large number of countries, including developing countries and emerging market

economies, to examine whether some of the factors identified in the theoretical literature are indeed

important in explaining the effectiveness of fiscal policy in responding to a recession. The focus is on

episodes of recession and the associated fiscal policy response. Given the large number of countries

and episodes, and differences in the size and composition of fiscal responses, initial conditions, and

accompanying policies and developments, the paper explores three different and complementary

approaches to try to account for the interactions between fiscal policy and growth during recession

episodes: descriptive analysis, multidimensional statistical analysis, and standard regression analysis.

JEL Classification Numbers: C21, E62, E65, H30

Keywords: Fiscal policy, stabilization, recession, principal components and cluster analysis.

1

Paper to be presented at Second Annual Research Conference organized by the International Monetary Fund,

Washington DC, November 29-30, 2001. We thank Richard Hemming for his constant encouragement and

suggestions, Michael Kell for helpful comments, and Estella Macke for her excellent research assistance. The

usual disclaimer applies.

- 2 -

I. Introduction 3

II. Definitions and Data 4

A. Definitions.................................................................................................................4

B. Data ...........................................................................................................................5

III. Descriptive Analysis 7

A. Overview of Recession Episodes..............................................................................7

B. Fiscal Response During a Recession.........................................................................9

C. Fiscal Response and Economic Activity in a Recession.........................................12

Initial conditions ..............................................................................................13

Composition of fiscal policy............................................................................15

Accompanying policies....................................................................................16

D. Sensitivity Analysis.................................................................................................17

Sample..............................................................................................................17

Selection bias ...................................................................................................17

E. Preliminary Findings...............................................................................................18

IV. Exploratory Multidimensional Analysis 19

A. Rationale .................................................................................................................19

B. Principal Components Analysis..............................................................................20

C. Cluster Analysis ......................................................................................................22

D. What Have We Learned?........................................................................................30

V. Estimates of a Reduced-Form Equation 32

A. Methodology...........................................................................................................32

B. Specification Search and Results ............................................................................32

Specification strategy.......................................................................................32

Model 1: Regional dummy variables..............................................................33

Model 2: Cluster dummy variables..................................................................33

VI. Concluding Remarks 35

Figures

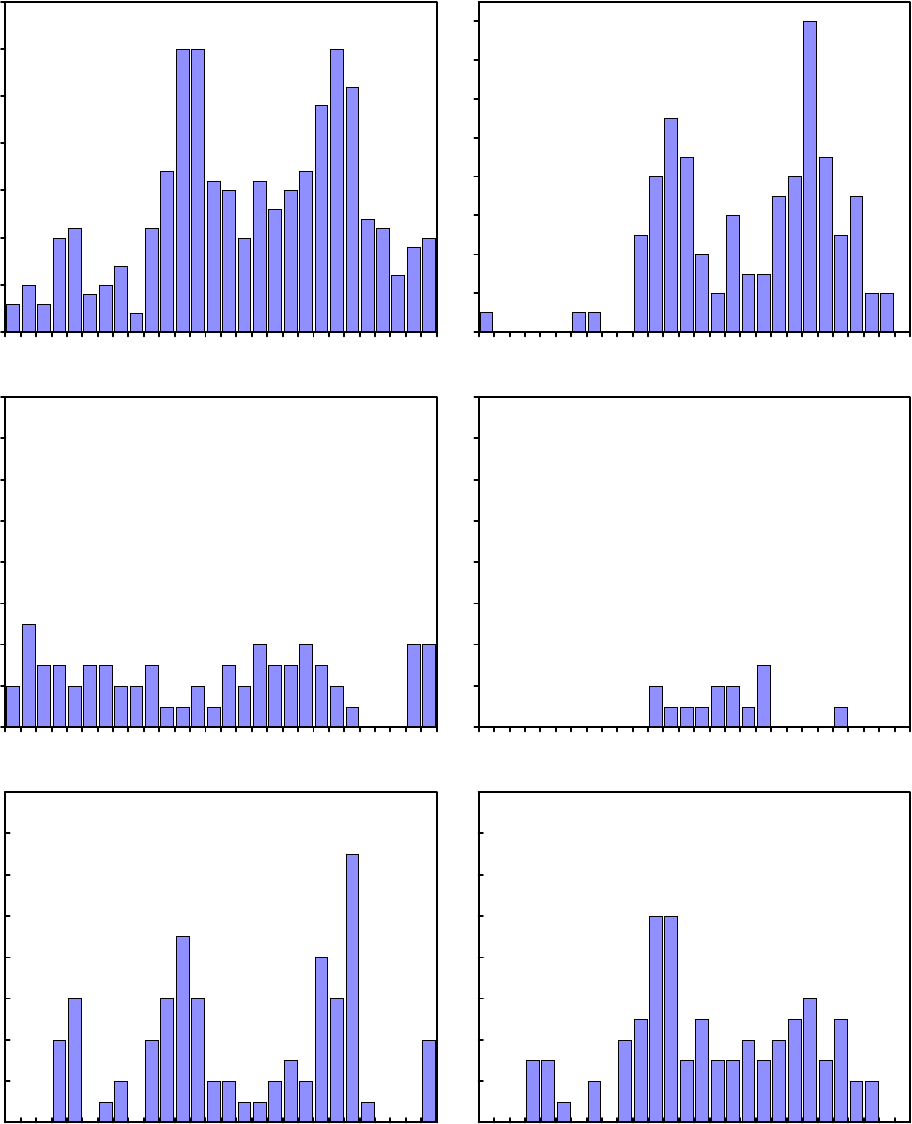

Figure 1. Number of Countries in Recessions, 1971-98............................................................8

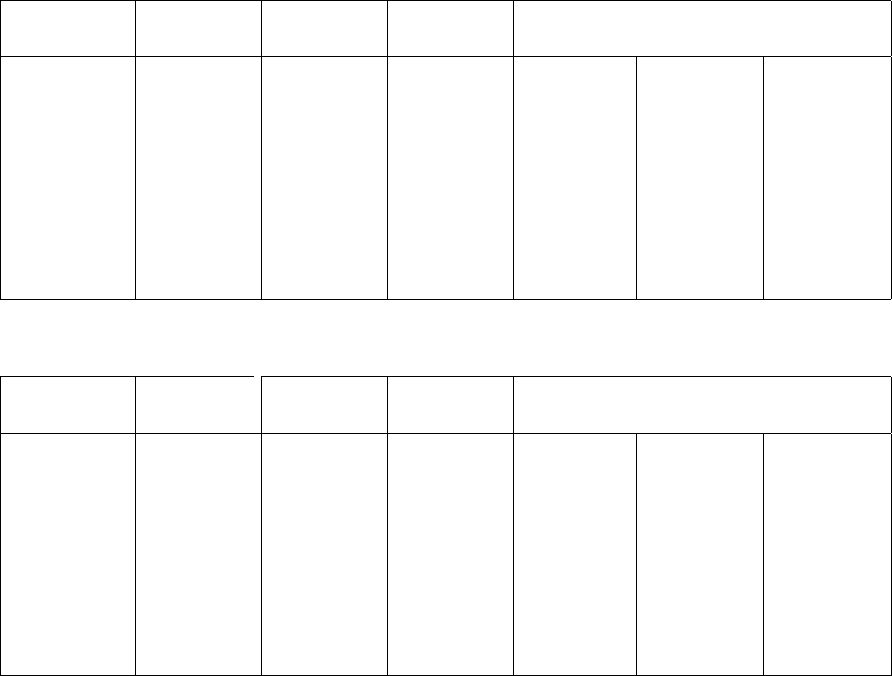

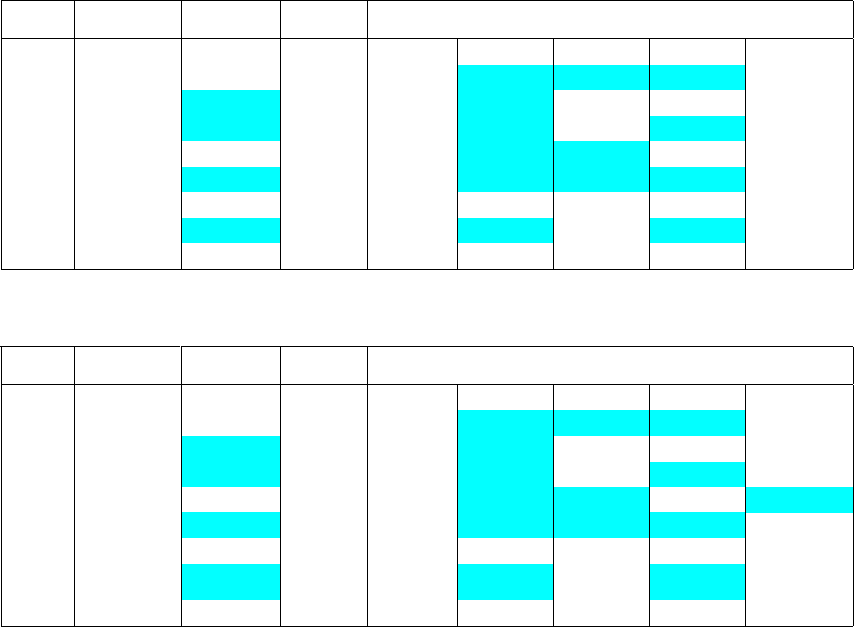

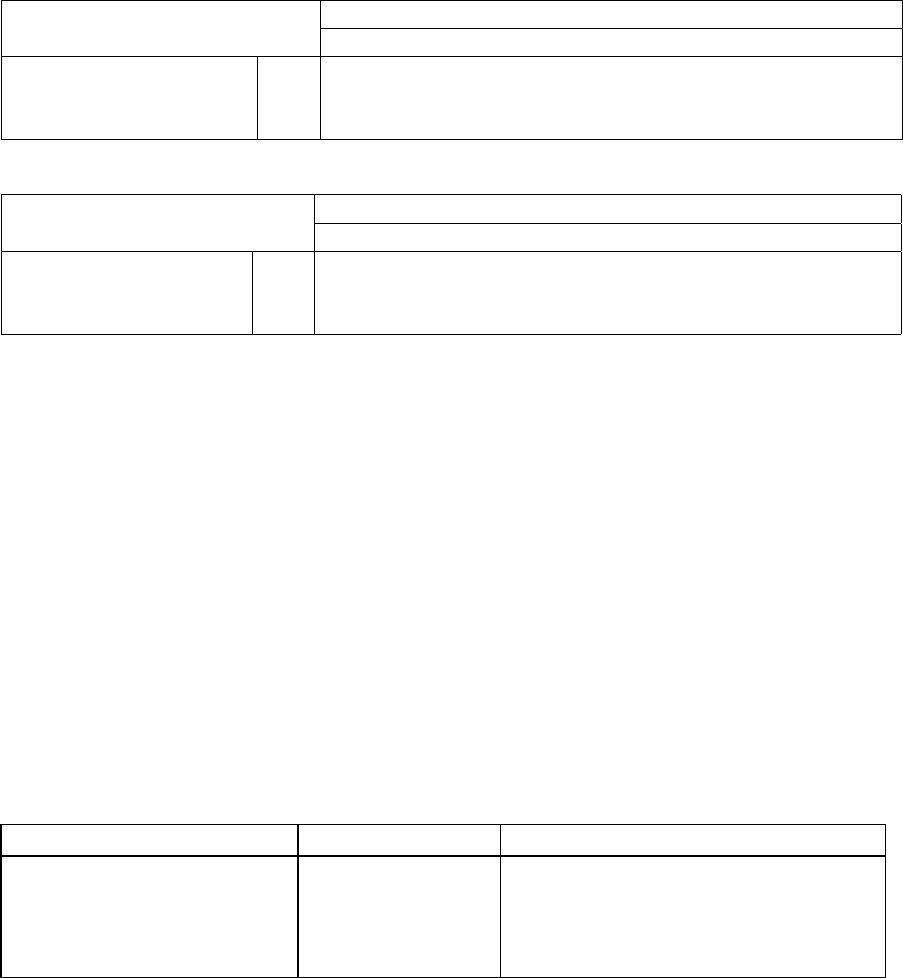

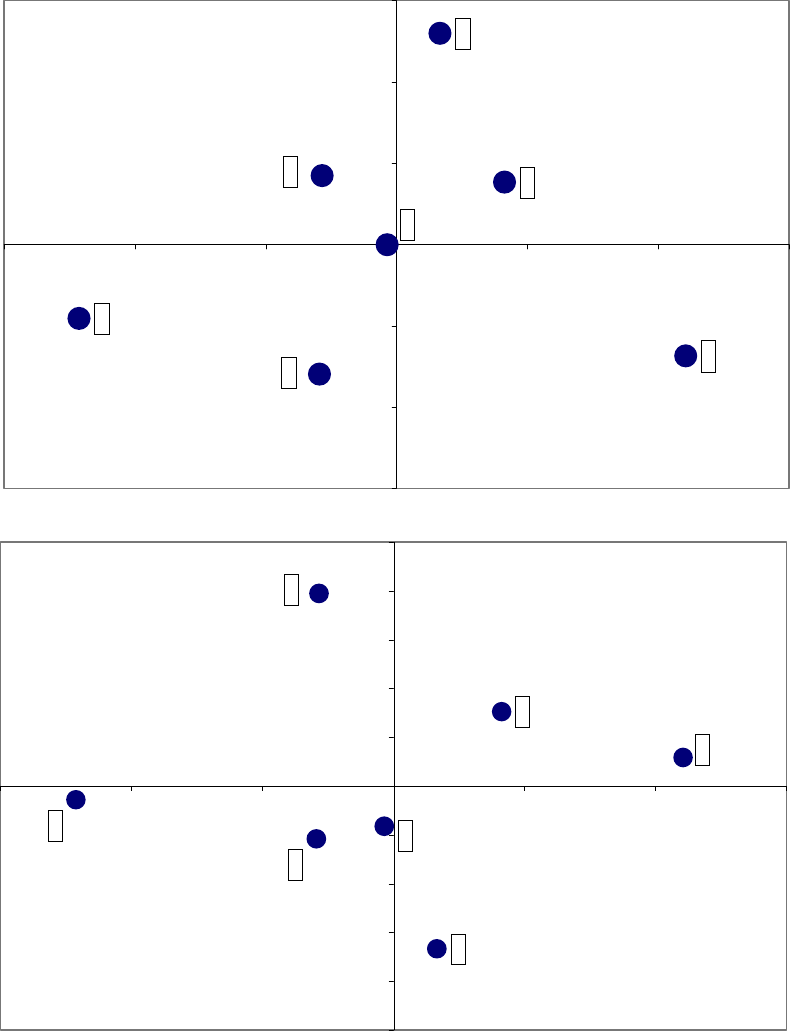

Figure 2. Distribution of Cluster Centers by Selected Factors ................................................28

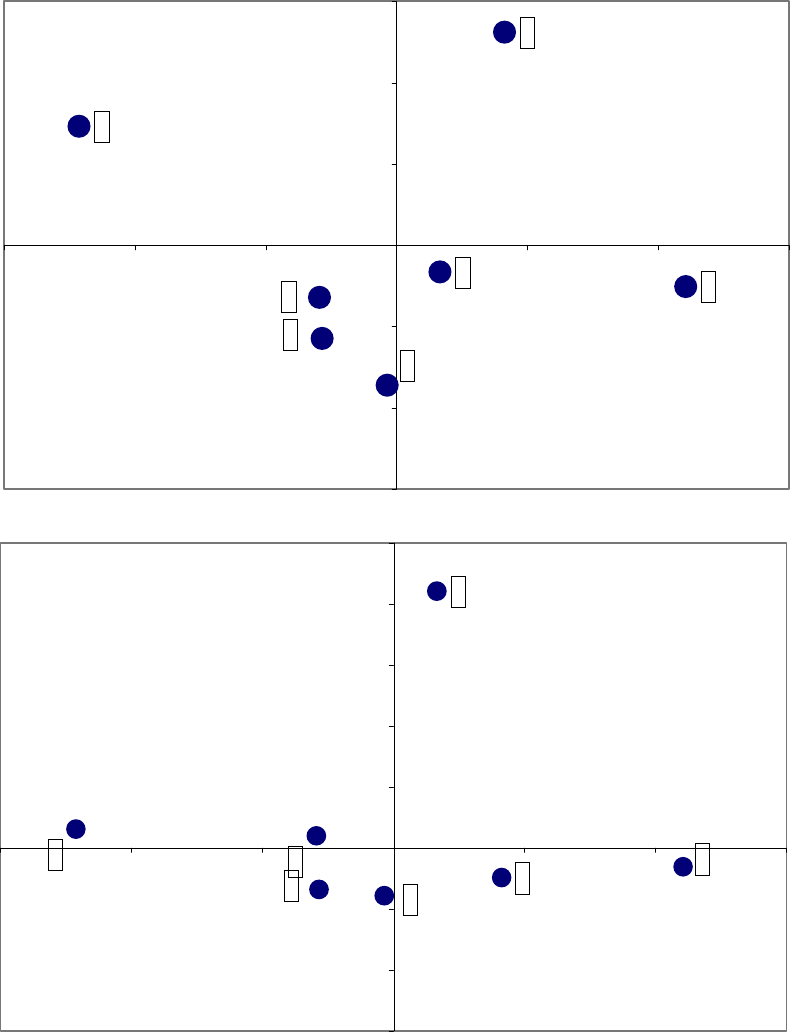

Figure 3. Distribution of Cluster Centers by Selected Factors ................................................29

Appendices

Appendix I. Variables, Definitions, and Data Sources............................................................37

Appendix II. Multidimensional Analysis: A Methodological Note.........................................40

- 3 -

I. I

NTRODUCTION

Recent years have seen a revival of the debate about the role of fiscal policy in stimulating

economic activity, particularly given the recessions in Asian crisis countries, the prolonged

slump in Japan and, more recently, the slowdown in the United States. Lane and others

(1999), while noting fiscal policy in the Asian crisis countries became increasingly oriented

toward supporting economic activity as the assessment of the economic situation was

changing, point to the questions that remain about the effectiveness of fiscal stimulus during

a crisis. Even if it is generally agreed that there are circumstances where fiscal policy cannot

be loosened (e.g. when fiscal imbalances or debt sustainability problems are the root causes

of the crisis), whether and when expansionary fiscal policy is effective in supporting activity

needs to be studied further.

There is a large literature on the effectiveness of fiscal policy in stimulating economic

activity in the short term—see Hemming, Kell and Mahfouz (2000) for a review. Economic

theory suggests that fiscal multipliers are more likely to be positive and large when

economies are relatively closed, there is considerable slack in productive capacity,

government debt is low, fiscal expansion focuses on spending, and there is an accompanying

monetary expansion. Fiscal multipliers will be smaller, and could turn negative, when debt

sustainability problems result in large risk premia on interest rates, consumers are Ricardian,

expectations intensify crowding out effects, or a fiscal expansion increases uncertainty. The

empirical literature suggests that fiscal multipliers are typically positive, but small, and while

there is some evidence of negative fiscal multipliers, there is no clear consensus on the

preconditions for such an outcome. However, most of the empirical evidence is for advanced

and mainly G3 economies. The effectiveness of fiscal policy in emerging market economies,

countries in transition, and developing countries remains largely undocumented.

2

This paper uses data for a large number of countries, including developing countries and

emerging economies, to examine whether there is any evidence that some of the factors

identified in the theoretical literature are indeed important in explaining the effectiveness of

fiscal policy in responding to a recession.

Following the approach initiated by Giavazzi and Pagano (1996) and Alesina and Perotti

(1997), the focus is on specific episodes, but in this case it is episodes of recession rather

than episodes of fiscal expansion or contraction, and the response of fiscal policy and its

effectiveness in connection with these episodes. There are two main reasons for focusing on

recession episodes. First, the question of whether fiscal policy is effective in stimulating

economic activity is particularly crucial and often raised when a country is experiencing a

recession or downturn. Second, the impact of fiscal policy on economic activity is likely to

2

One notable exception is Giavazzi, Japelli, and Pagano (2000).

- 4 -

be more visible in periods of slow growth, when there is a lot of slack in the economy and the

priority is to revive the economy.

Given the large number of countries and episodes, and differences in the size and

composition of fiscal responses, diversity of initial conditions, and accompanying policies

and developments, together with the complexity of channels through which fiscal policy may

affect economic activity, no single approach can extract all the relevant information from the

data. The paper therefore explores three different and complementary approaches to try to

account for the interactions between fiscal policy and growth during recession episodes:

simple descriptive analysis, multidimensional statistical analysis, and regression analysis.

The paper is organized as follows. Section II presents the definitions and the data used in the

rest of paper. Section III reports stylized facts about economic activity and fiscal policy

during recession episodes. Section IV summarizes the results of a multidimensional statistical

approach which partitions the recession episodes into groups with common characteristics.

Based on the insights provided by the descriptive and statistical analyses, Section V reports

on an econometric investigation aimed at testing more formally the relationship between

economic activity and fiscal policy in recessions. Section VI contains the main conclusions.

II. D

EFINITIONS AND

D

ATA

A. Definitions

The following definitions are used in the rest of the paper:

• A recession episode is defined as a single year or consecutive years in which real

GDP growth is more than one standard deviation below trend growth (defined as the

average growth for the country over the period 1970-1999).

• The fiscal response during a recession episode is measured by the difference between

the average fiscal balance in percent of GDP during the episode and before the

episode, multiplied by the length of the episode.

3

When this difference is negative,

there is an expansionary fiscal response.

• The severity of a recession is measured by the cumulative difference over a

recession episode between real GDP growth and trend growth.

4

This measure can be

broken down into average annual growth (relative to trend growth) during the

recession and the length of the recession.

3

Thus, if the fiscal deficit was 1 percent of GDP before the recession, and increased to 4 then 5 percent over a

two-year recession, the fiscal response would be -7 percent of GDP.

4

Thus if a country’s real GDP growth was -1 percent during two years of recession, while trend growth over

1970-1999 was 2 percent, the severity of the recession would be -6 percent.

- 5 -

• The effectiveness of fiscal policy is measured by the difference in growth outcomes

during recession episodes accompanied by an expansionary fiscal policy and episodes

accompanied by a contractionary fiscal policy. While not an exact measure of the size

of fiscal multipliers, this measure distinguishes whether they are positive or negative.

The correction for trend growth in defining and measuring the severity of a recession reflects

the view that differences in trend growth across countries—which are quite large in our

sample—reflect structural factors unrelated to the response of fiscal policy.

The use of the change in the actual fiscal balance to measure the stance of fiscal policy is

primarily dictated by the absence of data on structural balances for most of the countries in

the sample. The advantages of using the actual balance are that automatic stabilizers are

therefore part of the fiscal response and that it avoids making a contentious distinction

between the discretionary and automatic components of fiscal policy in a recession.

5

On the

other hand, since the actual balance is likely to be influenced by real GDP growth, it will be

necessary to account for possible endogeneity bias (see Sections III and V).

B. Data

One of the objectives of this study is to have as broad a coverage of countries and episodes as

possible. As a result, the choice of the variables used and the empirical strategy is largely

driven by data availability. The sample covers 168 countries over the period 1970-1999.

6

Annual data are largely derived from a number of IMF databases, complemented by World

Bank public debt data.

7

Countries are divided into six groups, based on the World Economic Outlook (WEO) country

classification: advanced economies (ADV), including newly industrialized Asian economies,

four groups of developing countries, Africa (AFR), developing Asia (ASIA), Middle East

(ME) and Western Hemisphere (WH), and countries in transition (CIT).

Although the theoretical literature suggests a long list of factors that may influence the

effectiveness of fiscal policy (see Box 1 in Hemming, Kell, and Mahfouz (2000)), many of

these (e.g. uncertainty, sensitivity of consumption and investment to interest rates) are

5

Determining what constitutes a discretionary policy action remains highly judgmental since any forms of

policy inaction can be viewed as a deliberate choice to maintain the status quo. For a discussion of this issue in

the context of the Asian crisis, see Box 2.5. “Fiscal balances in the Asian Crisis Countries. Effects of Changes

in the Economic Environment Versus Policy Measures,” in IMF, 1998.

6

For countries in transition, episodes prior to 1994 (transition period) are excluded.

7

A detailed presentation of data sources and variables is given in Appendix 1.

- 6 -

difficult to quantify for a large number of countries. The analysis is therefore limited to the

following factors:

8

Initial conditions:

• slack in the economy, measured by real GDP growth before the recession,

• openness, measured by the ratio of imports to GDP before the recession,

• exchange rate regime, measured by a dummy variable (flexible or fixed),

• debt sustainability, measured by the public debt to GDP ratio before the recession,

• financing constraints facing the government, measured by the fiscal deficit, the

current account deficit (both in percent of GDP), and the ratio of foreign exchange

reserves to imports, before the recession,

Characteristics of the fiscal response:

• composition of fiscal policy, measured by changes in revenue and expenditure ratios.

Accompanying policies:

• stance of monetary policy, measured by changes in interest rates or in M2 to GDP,

• exchange rate policy, measured by the change in the exchange rate.

In addition to the above factors which are directly derived from the theoretical literature, a

few variables ( government size, financial depth, terms of trade shocks, inflation, and

regional growth) are used to capture other influences.

Finally, an episode is included in the sample only when data for both growth and the fiscal

deficit is available before, during and after the episode. After eliminating outliers,

9

the

sample is reduced to 276 recession episodes covering 129 countries (see Appendix 1 Table

A1 for a list of all the episodes).

In a few instances, data limitations reduce the sample size.

When this is the case, the number of episodes on which the analysis is based is indicated.

8

However, the variables used only in any section of the paper depend on the methodology used.

9

Outliers are defined as episodes for which growth or the fiscal deficit are above 15 percent in absolute value.

See also Section III and Appendix 1.

- 7 -

III. D

ESCRIPTIVE

A

NALYSIS

This section examines some stylized facts on the relationship between growth and fiscal

policy during recession episodes.

A. Overview of Recession Episodes

Recession episodes have certain clear general characteristics.

• They tend to cluster around certain years, such as 1974-75, 1982-83, 1991-93 and

1997-98 (Figure 1). This clearly points to the influence of some common external or

other causes, such as the oil shocks or the Asian crisis.

• They are generally quite severe. The severity of the recession is –8.7 percent on

average for the overall sample, and annual growth during a recession episode is on

average –6.5 percent relative to trend growth (Table 1). This represents a very large

fall in real GDP growth. In most cases, growth turns negative during a recession.

However, in a few cases, where trend growth is very high, growth may remain

positive while falling significantly below trend growth.

• They tend to be relatively short. The average length of a recession is 1.3 years,

reflecting the fact that 75 percent of the episodes are only one-year long while only a

few episodes are more than four-years long.

• There is a lot of variance among recession episodes. The standard deviation is thus

6.1 percent for the severity of a recession and 0.7 years for the length.

There are also important differences across country groups. Recessions are more severe on

average in the Middle East, Western Hemisphere and in countries in transition, and less

severe in advanced economies.

Table 1. Overview of Recessions

Area Number of episodes Depth Length Growth (relative to long term growth)

Before During After

AFR 84 -9.5 1.3 0.4 -7.3 1.0

ASIA 52 -8.0 1.3 0.3 -6.0 0.4

MED 13 -10.5 1.1 -0.8 -9.6 -0.4

ADV 61 -5.8 1.4 -0.6 -4.4 0.0

WHD 59 -10.3 1.5 0.3 -7.1 0.8

TRANS 7 -11.9 1.3 -3.8 -9.3 -0.3

ALL

276

-8.7

(6.1)

1.3

(0.7)

0.0

(3.2)

-6.5

(3.1)

0.5

(3.1)

Note: the table presents unweighted averages, standard deviations for the overall sample are in parentheses.

- 8 -

Figure 1. Number of Countries in Recessions, 1971-98

0

5

10

15

20

25

30

35

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

ALL

AFR

0

2

4

6

8

10

12

14

16

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

ASIA

0

2

4

6

8

10

12

14

16

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

ME

0

2

4

6

8

10

12

14

16

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

ADV

0

2

4

6

8

10

12

14

16

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

WH

0

2

4

6

8

10

12

14

16

1971 1974 1977 1980 1983 1986 1989 1992 1995 1998

- 9 -

B. Fiscal Response During a Recession

On average, the fiscal response during a recession is expansionary (Table 2). There are,

however, differences between country groups: advanced economies exhibit by far the largest

expansionary fiscal response (about -3 percent of GDP on average), while Middle East and

Western Hemisphere countries have on average a slightly contractionary fiscal response. To

examine the effectiveness of fiscal policy, recession episodes are then divided into two

groups, those where fiscal policy was expansionary and those where it was contractionary.

Table 2. Fiscal Policy During Recession Episodes

Area Number of episodes Fiscal response Fiscal deficit

Before During After

AFR 84 -1.1 4.8 5.4 5.3

ASIA 52 -0.9 4.5 5.2 4.7

MED 13 0.2 5.6 4.7 4.5

ADV 61 -3.1 1.3 3.2 3.5

WHD 59 0.5 4.0 4.1 2.9

TRANS 7 -0.5 6.0 6.2 4.0

ALL

276

-1.1

(5.6)

3.9

(4.7)

4.6

(4.1)

4.2

(4.2)

Note: the table presents unweighted averages, standard deviations for the overall sample are in parentheses.

Fiscal policy appears procyclical in 40 percent of the recession episodes (Table 3).

10

The two

groups are clearly differentiated, with a fiscal response of about –3¾ percent of GDP for

expansionary episodes compared to +3 percent of GDP for contractionary episodes, even

though the variance around these numbers is quite large There are also interesting differences

between country groups: in particular, fiscal policy is more often expansionary and fiscal

contractions tend to be smaller in advanced economies than in the other regions. This result is

consistent with, and generalizes, the findings of Gavin and Perotti (1997) that fiscal policy is

more countercyclical in advanced economies than in other regions (in their paper, the

comparison is with Latin America).

The stance of fiscal policy in a recession appears to be strongly correlated with the country’s

fiscal situation prior to the recession. The fiscal deficit prior to the recession is significantly

larger for episodes accompanied by a fiscal contraction than for episodes accompanied by a

fiscal expansion. This result holds for all the groups, with the difference being particularly

striking for advanced economies and Middle East countries. Public debt is also higher on

10

Due to the small size of the sample, results for countries in transition are not shown in the rest of the paper,

although they remain included in the overall sample.

- 10 -

average before contractionary episodes (Table 4). Government size, as measured by revenue-

to-GDP ratio, is larger for episodes with expansionary fiscal policy. Even though this result is

partly driven by advanced economies, it holds for most of the groups and may be explained

by the fact that automatic stabilizers are larger in countries with a large government.

Table 3. Expansionary versus Contractionary Fiscal Response During Recessions

Expansionary fiscal response

Area

Number of

episodes

Percent of total Fiscal response

Fiscal deficit

Before During After

AFR 49 58 -4.0 3.6 6.4 6.5

ASIA 26 50 -3.2 2.8 5.3 4.3

MED 7 54 -4.4 2.4 5.6 3.6

ADV 49 80 -4.1 0.3 2.8 3.1

WHD 30 51 -3.8 3.2 6.1 4.4

ALL

166

60

-3.8

(4.7)

2.5

(4.2)

5.1

(3.9)

4.6

(4.0)

Contractionary fiscal response

Area

Number of

episodes

Percent of total Fiscal response

Fiscal deficit

Before During After

AFR 35 42 3.0 6.4 4.1 3.6

ASIA 26 50 1.5 6.2 5.0 5.2

MED 6 46 5.5 9.3 3.8 5.5

ADV 12 20 0.8 5.4 4.6 5.1

WHD 29 49 4.9 4.9 2.0 1.3

ALL

110

40

3.0

(4.4)

6.0

(4.6)

3.7

(4.3)

3.6

(4.3)

Note: the table presents unweighted averages, standard deviations for the overall sample are in parentheses.

Fiscal policy during a recession also appears strongly linked to external factors. In particular,

expansionary episodes are accompanied on average by a deterioration in the terms of trade,

while episodes with a contractionary fiscal response are characterized on average by an

improvement in the terms of trade. This result applies to all the country groups. One possible

explanation is that terms of trade shocks directly affect the fiscal deficit in many countries

(e.g. through export duties). A deterioration in the terms of trade would thus both increase the

fiscal deficit and reduce growth. Another possible explanation is that governments are more

prone to let the deficit increase when the recession is caused by a negative terms of trade

shock than when it is caused by other factors. The current account deficit is also generally

- 11 -

larger before episodes accompanied by a contractionary fiscal response, which could reflect

the impact of external financing constraints.

Finally, recessions accompanied by a contractionary fiscal response are also characterized by

higher inflation. This may be explained by the fact that a number of recession episodes in

these regions are in countries with very high rates of inflation, and contractionary fiscal

policy is only one element of a broader stabilization package.

Table 4. Factors Related to the Stance of the Fiscal Response

Expansionary fiscal response

Area Public debt Government size Terms of trade Current account balance Inflation

Number of

episodes

In percent

of GDP

Number of

episodes

Revenue

to GDP

Number of

episodes

In percent

of GDP

Number of

episodes

In percent

of GDP

Number of

episodes

In

percent

AFR 48 66.5 49 24.8 49 -3.0 43 -4.8 48 13.7

ASIA 20 23.4 26 24.7 24 -1.9 23 -2.4 25 6.7

MED 6 12.1 7 30.1 7 -13.9 6 0.6 7 17.7

ADV 47 24.2 49 39.8 44 -2.1 46 -2.3 49 10.3

WH 27 31.2 30 23.1 30 -0.1 28 -4.2 24 19.5

ALL 153 38.4 166 29.3 159 -2.6 151 -3.4 156 12.7

Contractionary fiscal response

Area Public debt Fiscal size Terms of trade Current account balance Inflation

Number of

episodes

In percent

of GDP

Number of

episodes

Revenue

to GDP

Number of

episodes

In

percent

Number of

episodes

In percent

of GDP

Number of

episodes

In

percent

AFR 34 47.9 35 21.3 35 5.7 34 -5.3 35 16.0

ASIA 20 27.1 26 21.2 26 2.6 26 -2.0 26 11.8

ME 6 47.8 6 29.6 6 9.2 6 -3.9 5 15.5

ADV 11 55.9 12 35.4 11 4.0 12 -1.2 12 7.1

WH 24 35.5 29 21.5 29 3.8 27 -5.6 23 21.0

ALL 97 40.9 110 23.6 109 4.6 107 -4.1 101 15.0

Turning to the composition of fiscal policy, expansionary fiscal responses generally reflect

increases in public expenditure rather than tax cuts, while contractionary responses are

achieved through a mix of tax increases and expenditure cuts (Table 5). The asymmetry of

expansionary fiscal responses is particularly striking for Africa, advanced economies and

Western Hemisphere countries, and is observed in all country groups except Middle East. It

- 12 -

is also interesting to note that advanced economies are the only group in which expenditures

increase even when the fiscal response is contractionary.

Table 5. Composition of Fiscal Response During a Recession

Expansionary fiscal response

Area Number of episodes Change in expenditure Change in revenue

AFR 49 2.2 -0.6

ASIA 26 1.5 -1.0

ME 7 -0.1 -3.3

ADV 49 2.8 0.3

WH 30 2.9 0.1

ALL 166 2.2 -0.4

Contractionary fiscal response

Area Number of episodes Change in expenditure Change in revenue

AFR 35 -1.2 1.1

ASIA 26 -1.3 0.0

ME 6 -3.3 2.3

ADV 12 1.6 2.4

WH 28 -1.9 1.1

ALL 109 -1.2 1.0

C. Fiscal Response and Economic Activity in a Recession

On average, recession episodes accompanied by an expansionary fiscal response are less

severe. The average severity of recessions accompanied by an expansionary fiscal response is

–8.4 percent, compared to –9.2 percent for episodes characterized by a contractionary fiscal

policy (Table 6). The difference is largest in Asian and Western Hemisphere countries, and

holds for all country groups except Africa and advanced economies. On an annual basis (i.e.

abstracting from differences in the length of recession), all country groups have higher

growth relative to trend during episodes with expansionary fiscal policy compared to those

with contractionary fiscal policy. Endogeneity of the fiscal response would lead to the

opposite correlation.

On the other hand, growth immediately after the recession is not systematically higher or

lower depending on the stance of fiscal policy during the episode. However, as recessions

- 13 -

accompanied by contractionary fiscal policy are generally deeper, the rebound in growth

tends to be larger after contractionary fiscal responses.

Table 6. Growth and Fiscal Response During Recession Episodes

Expansionary fiscal response

Area

Number of

episodes Severity Length Growth (relative to trend growth)

Before During After Decline Rebound

AFR 49 -9.9 1.4 0.1 -7.1 1.1 -7.3 8.2

ASIA 26 -7.6 1.2 0.4 -6.0 0.2 -6.3 6.2

MED 7 -10.3 1.1 -2.4 -8.6 -1.1 -6.2 7.5

ADV 49 -5.9 1.4 -0.4 -4.3 0.0 -3.9 4.4

WHD 30 -9.5 1.4 0.4 -6.8 0.8 -7.2 7.6

ALL 166 -8.4 (6.1) 1.4 (0.6) 0.0 (2.6) -6.2 (3.0) 0.5 (3.1) -6.1 6.6

Contractionary fiscal response

Area

Number of

episodes Severity Length Growth (relative to trend growth)

Before During After Decline Rebound

AFR 35 -9.0 1.2 0.7 -7.7 1.0 -8.4 8.6

ASIA 26 -8.3 1.3 0.2 -6.0 0.6 -6.2 6.6

MED 6 -10.7 1.0 1.1 -10.7 0.6 -11.8 11.2

ADV 12 -5.5 1.2 -1.2 -4.5 -0.3 -3.4 4.3

WHD 29 -11.2 1.6 0.2 -7.4 0.8 -7.5 8.2

ALL

110

-9.2

(6.1)

1.3

(0.7)

0.0

(3.9)

-7.1

(3.1)

0.7

(3.1)

-7.1

7.7

Shaded areas indicate observations consistent with effective fiscal policy as defined in Section II

To examine the influence of various factors on the relationship between fiscal policy and

growth during a recession, the sample is further split based on the values taken by both the

fiscal response and each of the relevant factors. Three broad categories of factors are

distinguished: (i) initial conditions, (ii) the composition of fiscal policy, and (iii)

accompanying policies.

Initial conditions

Openness and exchange rate regime

In principle, the effectiveness of fiscal policy in stimulating economic activity depends on

whether an economy is open or not, and on the exchange rate regime and degree of capital

mobility. Fiscal policy is less effective in open economies than in closed economies because

- 14 -

there is some crowding out through imports. With capital mobility, the effectiveness of fiscal

policy in an open economy is further reduced with a flexible exchange rate, while it is

increased (and possibly more than in a closed economy) with a fixed exchange rate. In the

absence of data on the degree of capital mobility, the analysis here distinguishes between

only three categories: closed economy, open economy with a flexible exchange rate, and

open economy with a fixed exchange rate.

Expansionary fiscal policy is associated with less severe recessions in closed economies or in

open economies with a fixed exchange rate (Table 7). Contractionary fiscal policy is then

associated with more severe recessions than in open economies with a flexible exchange rate.

These results appear remarkably consistent with the predictions of theory (assuming some

capital mobility).

Table 7. Openness and Exchange Rate Regime

Growth during recession Fiscal Policy

Expansionary Contractionary All

-5.8 -7.6 -6.6

-7.1 -6.3 -6.7

Closed

Open, and flexible exchange rate

Open, and fixed exchange rate

-6.1 -7.0 -6.4

Number of episodes: 118. Openness is defined as imports-to-GDP ratio higher than 30 percent.

Fiscal conditions

When initial fiscal conditions are favorable, expansionary fiscal policy appears to be

more effective. In particular, when public debt is relatively low before a recession (below 50

percent of GDP), expansionary fiscal responses are associated with better growth outcomes

during the recession than contractionary responses, whereas when public debt is high, the

fiscal stance appears to make no difference for the severity of the recession (Table 8). This is

consistent with the theoretical prediction that fiscal policy is less effective and crowding out

larger when public debt is high. On the other hand, the level of the fiscal deficit before a

recession does not seem related to the effectiveness of fiscal policy, whereas it appeared

important in determining the choice of the fiscal response, as shown in Table 3. One

interpretation is that it may be difficult to finance an increase in an already large deficit, but a

large deficit does not in itself necessarily signal sustainability problems, and may therefore

not reduce the effectiveness of fiscal policy. Moreover, fiscal policy appears to be more

effective in countries with a large government.

- 15 -

Table 8. Initial Fiscal Conditions and Fiscal Response

Growth during recession

Fiscal policy

Expansionary Contractionary All

High Yes

-6.9 -7.0 -6.9

public debt No

-6.0 -7.1 -6.4

before recession All

-6.2 -7.0 -6.5

Number of episodes: 250. High public debt is defined as higher than 50 percent of GDP

Growth during recession

Fiscal policy

Expansionary Contractionary All

Large Yes

-6.7 -7.2 -7.0

fiscal deficit No

-6.0 -6.8 -6.2

before recession All

-6.2 -7.1 -6.5

Number of episodes: 276 (full sample). Large fiscal deficit is larger than 5 percent of GDP.

Growth during recession

Fiscal policy

Expansionary Contractionary All

Large Yes

-4.8 -6.2 -5.2

government size No

-7.2 -7.4 -7.3

before recession All

-6.2 -7.1 -6.5

Number of episodes: 276 (full sample). Large government is when revenue-to-GDP is higher than 30 percent.

External conditions

Similarly, a sound external position before the recession leads to expansionary fiscal

response being accompanied by higher growth. Conversely, when the current account deficit

is large before the recession (i.e. above 5 percent of GDP), contractionary fiscal responses

are associated with higher growth (Table 9).

Table 9. Current Account Deficit Before Recession and Fiscal Response

Growth during recession

Fiscal policy

Expansionary Contractionary All

Large Yes

-7.6 -7.2 -7.4

current account deficit No

-5.6 -6.9 -6.1

before recession All

-6.2 -7.0 -6.6

Number of episodes: 258

Composition of fiscal policy

Expansionary fiscal policy appears to be more effective when it is expenditure-led during a

recession. On the other hand, there is virtually no difference for contractionary fiscal

responses (Table 10).

- 16 -

Table 10. Composition of Fiscal Policy and Fiscal Response

Growth during recession

Fiscal policy

Expansionary Contractionary All

Expenditure-led Yes

-5.8 -7.2 -6.3

Fiscal response No

-6.9 -7.0 -6.9

All

-6.2 -7.1 -6.5

Number of episodes: 275

Accompanying policies

Monetary policy

Fiscal policy appears to be more expansionary when monetary policy is also expansionary,

with an average increase in interest rates of 0.7 percent versus 1.2 percent. This makes it

difficult to disentangle the effects of monetary and fiscal policy in a recession. But, on

average, a recession is more severe when both monetary and fiscal policy are contractionary

than when they are both expansionary

11

(Table 11). These results are in line with the

predictions of the theory. Conversely, when monetary policy is restrictive, fiscal policy does

not seem to make much of a difference.

Table 11. Policy Mix and Growth During Recession Episodes

Growth during recession

Fiscal policy

Expansionary Contractionary All

Expansionary

-5.0 -5.6 -5.2

Monetary policy Contractionary

-6.5 -6.7 -6.6

All

-5.9 -6.3 -6.1

Number of episodes: 171

Exchange rate policy

Recessions preceded by an exchange rate depreciation are more severe on average than

recessions preceded by an appreciation, and their severity does not appear to be related to the

fiscal response. Similarly, exchange rate policy during a recession does not modify the

effectiveness of fiscal policy except that contractionary fiscal policy appears less costly when

accompanied by an exchange rate depreciation (Table 12).

11

Similar results are obtained when using the change in M2 to GDP.

- 17 -

Table 12. Exchange Rate Policy Before and During Episodes

Growth during recession

Fiscal Policy

Expansionary Contractionary All

Exchange rate Yes

-7.0 -6.9 -7.0

depreciation No

-4.7 -6.8 -5.4

before recession All

-6.2 -6.9 -6.5

Number of episodes: 229

Growth during recession

Fiscal Policy

Expansionary Contractionary All

Exchange rate Yes

-6.4 -6.9 -6.6

depreciation No

-5.6 -7.5 -6.3

during recession All

-6.2 -7.1 -6.5

Number of episodes: 276

D. Sensitivity Analysis

This section examines the sensitivity of the results to changes in the sample and to the

definitions used.

Sample

The results presented above are based on a sample in which outliers—defined as episodes

with growth or an overall balance to GDP above 15 percent in absolute terms—were

excluded. Since this criterion is arbitrary, we need to check how it may influence the results.

Alternative criteria for outliers, such as a cut off value of 10 percent rather than 15 percent,

or the exclusion of the extreme quintiles or deciles were thus explored. Table 13 shows that

even though the sample size varies substantially, the results are not very different.

Table 13. Impact of Filtering Method on Sample Size and Results

Filtering method Number of episodes Impact of fiscal response on growth (1)

+/-15 percent interval 276 0.9

+/-10 percent interval 199 0.7

1st and last quintiles excluded 216 0.7

1st and last deciles excluded 124 0.8

(1) Difference between average growth during episodes with expansionary and contractionary fiscal response

Selection bias

Another possible bias comes from the criterion used to define recessions. As growth during a

recession is measured by the difference between actual and trend growth, it is by definition

bounded by the standard deviation of real GDP growth for the country. This could result in

- 18 -

an undesired correlation between our measure of growth during a recession and the standard

deviation (which can be seen as a proxy for the volatility of real GDP growth) if growth

during was always very constrained by its upper bound. The average difference between

growth during a recession and this bound is 3.2 percent for the overall sample. It therefore

appears large enough—as a comparison, the standard deviation of real GDP growth is 4.4

over the sample—to suggest the definition of recession episodes does not bias the results.

12

E. Preliminary Findings

Overall, many of the observations in this section appear to be broadly in line with theoretical

predictions and the following stylized facts emerge:

• On average, fiscal policy is expansionary during recession episodes. However, a very

large number of recession episodes (40 percent of total) are accompanied by

contractionary fiscal policy. Unfavorable initial conditions (high public debt, and

large fiscal and current account deficits) are associated with a contractionary fiscal

response in a recession, while negative terms of trade shocks or a large public sector

tend to result in a more expansionary fiscal response.

• There is some evidence that expansionary fiscal policy dampens the severity of a

recession, especially in open economies with a fixed exchange rate, favorable initial

fiscal and external conditions (low public debt, a large public sector, and a small

current account deficit), and in combination with expansionary monetary policy.

Expenditure-led fiscal expansions are also associated with less severe recessions. All

these results are consistent with the predictions of the theory, even though the

magnitude of the average effects is small, and the variance is large.

• There are marked differences between advanced economies and other country groups.

The fiscal response is more often expansionary in advanced economies. At the same

time, the impact of fiscal policy tends to be smaller than in other groups.

• A number of other factors are associated with both the fiscal response and the severity

of a recession. Inflation tends to be higher, and monetary policy more contractionary

during episodes with a contractionary fiscal response, which makes the interpretation

of the results somewhat difficult and points to the need for a multivariate approach.

However, the methodology used here does not allow strong inferences on the relationships

between the different variables. In addition, the variance in the sample suggests that the

observed differences may not be significant. These issues will be examined in the regression

analysis presented in section V.

12

The result holds for each of the country group.

- 19 -

IV. E

XPLORATORY

M

ULTIDIMENSIONAL

A

NALYSIS

A. Rationale

The descriptive analysis of the previous section provides some insights into the nature and

impact of the fiscal response in a recession. However, it also suggests that many different

factors have to be taken into account simultaneously when assessing the relationship between

the main variables of interest. In this section a multidimensional analysis is used to identify

typologies of recession episodes and the associated fiscal responses. More specifically, the

idea is to identify episodes that constitute relatively homogenous groups for the variables of

interest and the key characteristics of these groups. The approach is exploratory since there

are no prior assumptions relating the variables. It is also multidimensional as it tries to

analyze the simultaneous interactions among these variables. To this end, two different

statistical techniques are used in sequence: principal components analysis and cluster

analysis.

Multidimensional statistical methods are designed to explain the correlations or covariances

among a set of variables in terms of a limited number of unobservable or latent variables

(Lebart, Morineau, and Piron, 1995). In reducing the number of original variables into a new

set of factors, these methods can extract information present in the original data that cannot

be observed directly either because it is difficult to measure (for instance, the set of initial

conditions discussed in the previous section) or because economic variables tend to be

measured with error. Principal components analysis is particularly useful in identifying a

small number of dominant factors among a large number of observed variables that explain

most of the variance of the original data (Dunteman, 1980). These factors or principal

components are linear combinations of the original variables, and can be interpreted on the

basis of their relation with the original variables.

13

Cluster analysis is then applied to the results of the principal components analysis to partition

the sample of recession episodes into homogenous groups. The objective is to sort episodes

into groups so that the degree of statistical association is high among members of the same

group and low between members of different groups (Everitt, 1974). Since it does not require

any assumption on the distribution of the variables in the population, the method is widely

used as an exploratory data analysis tool (Diday, 1982). However, since cluster analysis is a

descriptive rather than a probabilistic statistical method, it cannot be used to test any

hypothesis concerning the causal relationship between variables (Morrison, 1980). The

advantage of carrying out cluster analysis on the principal components is that groups can be

identified according to multidimensional concepts not directly observable in the original data.

13

For each factors, factor scores are calculated as a linear transformation of the standardized original variables

with weights proportional to the correlation coefficients between the original variables and the factor.

- 20 -

B. Principal Components Analysis

Principal components analysis aims at determining the coefficients that relate the observed

variables to a reduced number of dominant factors.

14

The key problems are how the

determine the optimal number of factors and how to interpret them. Two main criteria are

used. First, only factors that explain a larger portion of the total variance than individual

variables are extracted.

15

Second, these factors are interpreted, and hence labeled, by looking

at their correlation with the original variables. Principal components analysis is thus

performed on a matrix of 224 downturn episodes,

16

including the following groups of

variables identified in the previous section:

• nature of the recession (average growth during the episode and its length);

• fiscal response and composition of fiscal adjustment;

• initial conditions (fiscal deficit, debt, current account deficit, openness, etc..);

• accompanying monetary and exchange rate policies.

Eight principal components are identified, explaining about 75 percent of the total variance,

and the remaining 25 percent can be seen as a residual not related to the common

characteristics of the data. The factors are reported in Table 14 for each principal component

and can be interpreted as follows.

• Size of government. The first principal component is positively correlated with high

ratios of expenditure and revenue to GDP.

• Fiscal response. The second factor is correlated with fiscal responses and increases

in public expenditure, combined with small initial fiscal deficits (or fiscal surpluses).

• Terms of trade change during episode. The third principal component is strongly

and positively correlated with terms of trade improvements during the recession.

• Openness and financial depth along with monetary policy response. The fourth

factor is positively correlated to openness, expansionary monetary policy and

financial depth, as measured by the ratio of M2 to GDP.

14

These coefficients are called factor loadings and can be seen as playing a role similar to coefficients in

standard multivariate regression analysis.

15

In mathematical terms, this means that only factors with eigenvalues higher than one have been retained. To

identify principal components, we use Kaiser’s varimax criterion to orthogonally transform the original data.

16

The number of recession episodes is reduced from 276 to 224 when all the variables of interest are included in

the sample.

- 21 -

Table 14. Rotated Components Matrix and Total Variance Explained

• Initial conditions (public debt, reserves ratio and current account deficit). The fifth

factor is negatively correlated to favorable initial conditions;

• Macroeconomic conditions before the episode (inflation and growth before the

episode). The sixth component is positively correlated with low levels of inflation and

relatively high growth before the recession episode;

• Change in revenues. The seventh component is positively correlated with an

increase in the revenue-to-GDP ratio; and

• Change in the exchange rate. The final factor is positively correlated with the

change in depreciation during the recession.

Variables Components

12345678

Expenditures to GDP, before

0.93

-0.08 -0.01 0.17 -0.08 -0.11 -0.04 0.04

Revenues to GDP, before

0.91

0.20 -0.03 0.22 0.05 -0.10 -0.06 0.03

Growth during 0.57 0.05 0.04 -0.36 0.27 0.32 0.12 -0.19

Fiscal response -0.05

-0.93

0.13 -0.04 -0.01 -0.07 0.11 -0.01

Fiscal balance before 0.07

0.77

-0.04 0.17 0.33 -0.02 -0.06 -0.01

Change in expenditure to GDP 0.01

0.69

-0.09 0.03 0.01 0.05 0.68 0.00

Terms of trade shock -0.02 -0.09

0.99

0.00 -0.02 0.00 0.00 -0.01

Openess, before 0.21 0.13 0.08

0.79

-0.15 -0.09 -0.09 -0.04

Monetary response -0.08 0.06 -0.04

0.65

0.13 0.41 0.12 -0.04

M2 to GDP before 0.41 0.07 -0.10

0.61

0.32 0.01 0.01 -0.08

Current account balance, before 0.18 0.12 -0.05 -0.03

0.71

0.11 0.03 -0.08

Public debt before 0.06 -0.03 -0.03 0.05

-0.70

0.11 -0.12 -0.11

Reserves to imports before -0.04 0.10 -0.03 0.20

0.55

-0.08 -0.26 0.08

Inflation before -0.04 -0.08 0.06 -0.11 0.03

-0.85

0.05 0.03

Growth before -0.11 -0.02 0.05 -0.03 -0.06

0.73

0.03 0.16

Change in revenues to GDP -0.04 -0.16 0.03 -0.01 0.00 -0.02

0.96

-0.01

Change in exchange rate -0.11 -0.05 0.07 0.03 -0.05 0.04 0.01

0.75

Length of recession 0.11 0.06 -0.09 -0.11 0.14 0.07 -0.02

0.73

Sums of squared loadings 2.31 2.09 2.04 1.73 1.66 1.59 1.52 1.20

Total variance explained

In percent of total variance 12.16 11.00 10.74 9.10 8.72 8.36 8.02 6.30

Cumulative 12.16 23.16 33.90 43.00 51.72 60.08 68.11 74.41

Extraction Method: Principal Component. Rotation Method: Varimax with Kaiser Normalization, converged in 8 iterations.

- 22 -

C. Cluster Analysis

The eight factors thus identified are then used as input variables in the cluster analysis.

Selecting the optimal number of clusters is to some extent a subjective exercise. Using

alternative clustering algorithms ensures that robust partitions of the sample are identified.

Nonetheless, smaller clusters may present difficulties because they may not be easily

assimilated to other clusters as they tend to capture outliers. The strategy adopted here is to

select a limited number of large clusters while grouping the remaining clusters and outliers

into a single composite group.

Using a non-hierarchical algorithm (see Appendix II),

17

seven clusters representing 202

episodes are identified, while the remaining 22 episodes are grouped in a residual cluster.

18

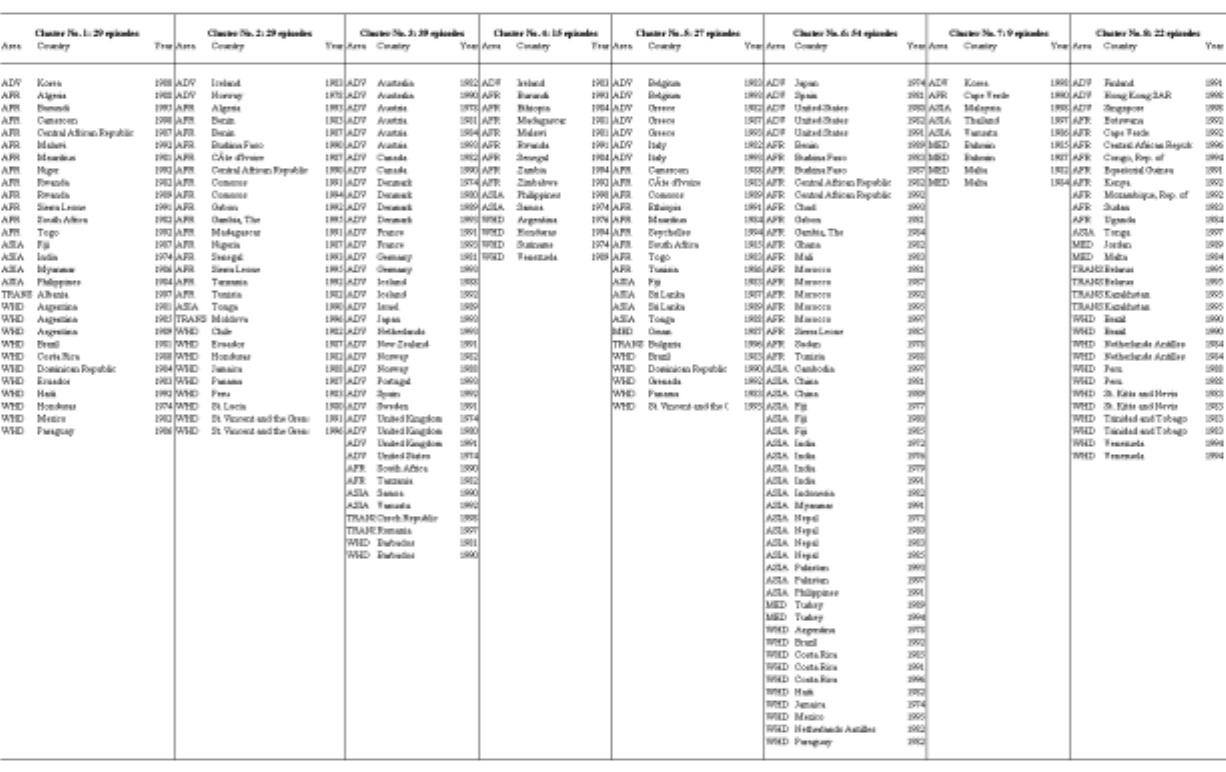

The distribution of episodes by cluster membership and region is presented in Table 15.

19

Advanced economies are concentrated in cluster 3, which groups 61 percent of the episodes

for this region. More than half of the Asian countries are in cluster 6. Middle Eastern

countries are mostly in cluster 7. Other regions tend to be more evenly spread across clusters,

although countries in transition are in a large part in clusters 3 and 8, African countries in 2

and 6, and Western Hemisphere countries in 1 and 6. Most of the 1998 Asian crisis countries

are included in cluster 7. Outliers (cluster 8) are fairly evenly distributed across regions,

except for an over-representation of countries in transition.

Descriptive statistics and tests are calculated within each cluster and across clusters to

identify variables that are significantly different from the sample average (Table 16).

20

Active

variables that are used in the principal components and cluster analysis are distinguished

from illustrative variables that are helpful in describing the characteristics of the clusters.

17

Appendix II briefly reviews cluster analysis and clustering algorithms. As changes in the pre-determined

number of clusters can produce groups with different characteristics, a robustness check using alternative

numbers of partitions was conducted. It showed that the identified clusters are relatively stable implying that

they identify “strong partitions” in the original data.

18

Caution is needed in the interpretation of the results for this cluster as it aggregates smaller clusters and

isolated episodes (outliers).

19

A list of all episodes by clusters is reported in Table A2 in Appendix II.

20

Non parametric statistics are also used to test the assumption that the means are equal across the groups and

confirm they are statistically different across the clusters.

- 23 -

Table 15. Clusters Composition by Region

Four clusters (47 percent of the sample) group countries that responded to the recession with

expansionary fiscal policies.

• Cluster 1 (29 episodes) groups episodes with the most severe recessions, both in

terms of the average growth and the length of the recession. African and Western

Hemisphere countries account for 80 percent of the episodes in this cluster. The fiscal

policy is driven by higher spending while monetary policy is restrictive. Government

size tends to be small and financial sectors not particularly developed. In addition, the

episodes are accompanied on average by large negative terms of trade shocks and

exchange rate depreciations—especially the three Argentina episodes (1981-82, 1985,

and 1989), Costa Rica (1980-82), Mexico (1982-83), and Sierra Leone (1991-92)—

preceded by relatively high inflation rates.

• Cluster 2 (29 episodes) contains relatively short recessions of average depth. Fiscal

expansion is sizeable (about 4½ percent of GDP), driven by a mix of expenditure

increases and, to a lesser extent, tax cuts, and accompanied by a mild monetary

contraction. Initial conditions point to a mix of high public debt—the Gambia (1994),

Madagascar (1991), Tanzania (1992), and Jamaica (1988)—and large current account

deficits—Chile (1982-85), Honduras (1982-83), Madagascar (1991), and Nigeria

(1987). Inflation is relatively low both before and during the recession. Similar to the

Area Clusters12345678Total

ADV No. 12311751351

in percent of area 2.0 3.9 60.8 2.0 13.7 9.8 2.0 5.9 100.0

in percent of cluster 3.4 6.9 79.5 6.7 25.9 9.3 11.1 13.6 22.8

AFR No.

12 16 2 8 9 18 1 9 75

in percent of area 16.0 21.3 2.7 10.7 12.0 24.0 1.3 12.0 100.0

in percent of cluster 41.4 55.2 5.1 53.3 33.3 33.3 11.1 40.9 33.5

ASIA No. 41224193136

in percent of area 11.1 2.8 5.6 5.6 11.1 52.8 8.3 2.8 100.0

in percent of cluster 13.8 3.4 5.1 13.3 14.8 35.2 33.3 4.5 16.1

MED No. 12418

in percent of area 12.5 25.0 50.0 12.5 100.0

in percent of cluster 3.7 3.7 44.4 4.5 3.6

TRANS No.

112 1 27

in percent of area 14.3 14.3 28.6 14.3 28.6 100.0

in percent of cluster 3.4 3.4 5.1 3.7 9.1 3.1

WHD No. 11924510 647

in percent of area 23.4 19.1 4.3 8.5 10.6 21.3 12.8 100.0

in percent of cluster 37.9 31.0 5.1 26.7 18.5 18.5 27.3 21.0

Total No. 29 29 39 15 27 54 9 22 224

in percent of area 12.9 12.9 17.4 6.7 12.1 24.1 4.0 9.8 100.0

in percent of cluster 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0 100.0

- 24 -

Table 16. T-tests and Kruskal-Wallis Tests by Variables and Clusters

Clusters Cluster no. 1 Cluster no. 2 Cluster no. 3 Cluster no. 4 Cluster no. 5 Cluster no. 6 Cluster no.7 Cluster no. 8 Total

Active variables Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean K-W Median

Growth

Growth during -8.2 *** -6.7 -3.8 *** -8.9 *** -5.7 -5.8 ** -8.9 -8.1 ** -6.4 *** ***

Length of recession 1.6 1.1 *** 1.6 ** 1.1 *** 1.3 1.1 *** 1.1 * 1.8 1.3 *** ***

Growth before 0.2 0.1 -0.1 0.3 -1.3 ** 1.2 ** -1.7 ** -1.9 -0.1 **

Policy response

Fiscal response -1.1 -4.3 *** -2.2 *** 1.0 ** 2.9 *** 0.3 *** -2.3 * -0.8 -0.8 *** ***

Monetary response -0.5 *** 0.5 0.8 -0.1 ** 0.7 1.9 9.3 ** 3.6 1.4 *** **

Initial conditions

Public debt before 35.1 54.2 ** 27.9 *** 52.8 ** 56.3 *** 31.1 *** 14.1 *** 52.6 40.0 *** ***

Fiscal balance before -5.0 * -0.7 *** -1.2 *** -7.6 -8.9 *** -4.8 -0.8 ** -3.7 -4.1 *** ***

Current account balance, bef. -5.0 -6.8 ** -1.7 *** -8.4 -5.3 -3.0 *** -1.8 -6.1 -4.4 *** ***

M2 to GDP before 29.0 *** 29.7 *** 56.5 *** 26.8 *** 41.9 34.0 *** 84.5 *** 46.9 40.5 *** ***

Inflation before 53.7 12.6 *** 9.3 *** 35.9 14.9 *** 26.3 ** 3.2 *** 281.2 48.5 ** **

Reserves to imports before 23.3 17.9 ** 20.0 14.8 *** 13.2 *** 22.2 69.6 ** 33.2 22.8 **

Revenues to GDP, before 16.3 *** 26.1 42.7 *** 22.9 31.6 ** 17.8 *** 33.6 ** 28.9 26.7 *** ***

Expenditures to GDP, before 21.3 *** 26.9 ** 43.9 *** 30.5 *** 40.4 *** 22.6 *** 34.4 32.5 30.8 *** ***

Composition of fiscal policy

Change in expenditures to GDP 1.2 2.6 *** 2.0 *** 0.1 * -2.6 *** 0.4 1.2 2.6 0.9 *** ***

Change in revenues to GDP 0.1 -1.6 *** -0.3 1.1 0.3 0.7 ** -1.1 1.7 0.2 *** ***

Other factors

Openness 40.3 35.9 33.3 24.0 *** 42.4 * 24.0 *** 60.1 *** 51.3 *** 34.9 *** ***

Exchange rate depreciation 240.6 *** 17.2 *** 10.9 *** 47.5 ** 65.4 *** 30.9 *** 14.8 *** 13830.8 1412.8 ** **

Terms of trade change -0.2 *** 0.0 0.0 0.3 *** 0.0 0.0 ** -0.1 0.1 0.0 *** ***

Cluster no. 1 Cluster no. 2 Cluster no. 3 Cluster no. 4 Cluster no. 5 Cluster no. 6 Cluster no.7 Cluster no. 8 Total

Descriptive variables Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean t-test Mean K-W Median

Depth of recession -12.45 *** -7.94 -6.31 *** -9.54 -7.50 -6.37 *** -10.2 -13.5 ** -8.55 *** ***

Growth after 0.74 *** 0.83 *** -0.43 *** 0.15 * 0.63 *** 1.12 *** -2.0 ** 0.4 0.44 *

Decline in growth -8.44 ** -6.81 -3.76 *** -9.14 ** -4.48 *** -6.98 -7.0 -6.2 -6.36 *** ***

Rebound in growth 8.98 ** 7.53 3.41 *** 9.02 * 6.36 6.95 6.8 8.5 6.89 *** ***

Change in interest rates 2.59 *** 1.18 -2.55 ** -0.80 -0.63 -0.11 0.3 0.7 -0.18 *** ***

Fiscal balance -6.13 *** -5.01 *** -3.42 *** -6.63 *** -5.92 *** -4.48 *** -3.1 *** -4.5 *** -4.84 ** *

Fiscal balance after -5.14 -5.15 -4.14 -4.89 -4.98 -4.44 -2.5 -3.7 -4.51

Inflation during 158.49 15.09 *** 11.03 *** 53.19 36.18 * 36.43 ** -2.2 ** 365.4 77.15 *** ***

Exchange rate depreciation, bef. -84.71 -94.98 -101.39 *** -84.46 -91.37 -93.09 -93.7 -81.0 -91.74 *** ***

T-test to verify that for each variable cluster means are equal to the sample means. KW test and median test are non parametric tests of the hypothesis that variable means are equal across clusters.

The tests' significance levels are denoted as a ten (*), five (**), and one (***) percent, respectively.

- 25 -

previous cluster, African and Western Hemisphere countries account for more than 80

percent of the episodes, with more than half of the episodes falling in the African

region.

• Cluster 3 (39 episodes) has relatively longer but milder recessions than the sample

average. Fiscal expansion is driven by expenditure increases and accompanied by

monetary expansion. Countries in this cluster are characterized by large government

sector and favorable initial conditions (e.g., low inflation, almost balanced current

account, and low public debt and fiscal deficit ratios to GDP). The bulk of the

episodes (85 percent) is in advanced economies, including Israel (1989). Exceptions

include South Africa (1990-92), Tanzania (1982-84), Barbados (1981-82 and 1990-

92), and Samoa (1990), and two countries in transition, Czech Republic (1998) and

Romania (1997-98).

• Cluster 7 (9 episodes) is similar to cluster 3, except for a more accentuated

expansionary monetary policy response and a more balanced fiscal response. Asian

and Middle Eastern countries account for most of the group. Although rather small,

this cluster is of particular interest since it features some of the Asian crises.

Recessions are on average shorter and deeper, and they occur against generally

favorable fiscal and external initial conditions, although macroeconomic conditions

are less so.

Three clusters, covering 43 percent of the sample, are characterized by contractionary fiscal

policy.

• Cluster 4 (15 episodes) groups recessions that are shorter than the sample average

but show a deeper decline in output. The fiscal contraction is relatively mild (one

percent reduction in the deficit), largely driven by higher revenue. Monetary policy

was also tightened. Initial fiscal conditions are rather unfavorable, particularly in the

case of Zambia (1994) and Honduras (1994). The same applies to initial external

conditions, with fairly large current account deficits in Madagascar (1981), Rwanda

(1991), and Samoa (1974). Countries in this cluster tend to be African (53 percent)

and Western Hemisphere countries (27 percent).

• Cluster 5 (27 episodes) contains episodes in which the fiscal contraction is more

accentuated than in the previous group and mostly driven by expenditure reduction.

The monetary response is moderately expansionary. Initial fiscal conditions are less

favorable than the sample average in terms of higher fiscal deficit prior to the crisis—

Cameroon (1988), Cote d’Ivoire (1983-82), and Tonga (1988)—and high public debt

ratios—Ethiopia (1991-92) and Togo (1983). Countries in this group are also

characterized by a large public sector and consist of advanced (26 percent) and

African (33 percent) economies. Advanced economies are represented by Belgium

- 26 -

(1983 and 1993) and Italy (1982 and 1993), two of the tales of expansionary fiscal

contractions discussed in Alesina and Ardagna (1998).

21

• Cluster 6 (54 episodes) is the largest and most robust group. These recession

episodes are relatively short and mild. Fiscal contraction is mild (0.3 percent of

GDP), pursued by a mix of revenue increase and expenditure reduction, and

accompanied by a moderate expansionary monetary policy (1.9 percent). Countries in

this group have on average a small public sector size and relatively favorable initial

conditions, both fiscal and non-fiscal. Asian and African countries account for 69

percent of the episodes in this cluster. Notable exceptions are Turkey (1989 and

1994), the United States (1980, 1982, 1991), and Japan (1974).

• Finally, cluster 8 (22 episodes or 10 percent of the sample) groups episodes

characterized by hyperinflation and consequent sharp devaluation—Brazil (1990),

Peru (1988-90), Belarus (1995) and Kazakhstan (1995)—countries with an unusually

high degree of openness—Hong Kong SAR and Singapore— and episodes with very

unbalanced initial fiscal and external positions—the Republic of Congo (1994),

Equatorial Guinea (1991), the Republic of Mozambique (1992) and Sudan (1983-84).

It also includes very long episodes, reaching to 6 years in the case of Trinidad and

Tobago (1983-89). Table 17 summarizes the main characteristics of each cluster.

In general, recession episodes for the same country tend to fall consistently within the same

cluster. This seems to reflect both the relative stability of key structural characteristics, such

as government size, and some persistence in policy responses to a crisis. However, a few

exceptions are worth noting. At one extreme we find the three Philippines episodes (1984,

1991, and 1998) falling in three different clusters—clusters 1, 6, and 4, respectively. The

different policy responses in the case of the Philippines may be dictated, among other things,

by a steady increase in the government size, from 12 percent in 1974 to 20 percent in 1998.

Other cases are the United States—with the 1980, 1982, and 1991 recession episodes

characterized by a contractionary response, whereas the earlier 1974 episode followed what

appears to be a standard advanced economy response (fiscal expansion driven by expenditure

increases and accompanied by accommodating monetary policy)—and India, with four

episodes—1972, 1976, 1979, and 1991—characterized by an overall contractionary response

vis-à-vis the expansionary fiscal policy pursued during the 1974 episode.

21

Two other well documented cases of expansionary fiscal contractions, namely Denmark (1983-86) and

Ireland (1987-89), discussed in Giavazzi and Pagano (1990) and reviewed in Hemming, Kell, and Mahfouz

(2000) are not captured by our definition of recession. This is not surprising since these are episodes of

sucessful fiscal contraction, characterized by high growth.

- 27 -

Table 17. Summary Qualitative Description of Clusters

Cluster 1 Cluster 2 Cluster 3 Cluster 4 Cluster 5 Cluster 6 Cluster 7

Growth

Growth during

Low

Average

High Low

Average

High

Low

Length of

recession

Long

Short Long Short

Average

Short

Short

Depth of

recession

Severe

Average

Mild

Severe Average

Mild

Severe

Policy response

Fiscal response Expan. Expan. Expan.

Contr. Contr. Contr.

Expan.

Monetary

response

Contr. Expan. Expan.

Contr.

Expan. Expan.

Expan.

Initial conditions

Public debt Average

High Low High High Low Low

Fiscal deficit Average

Small Small

Large

Large

Average

Small

Current account

deficit

Average

Large Small

Large Average

Small

Small

Inflation Average

Low Low

Average

Low Low Low

Fiscal size

Small

Average

Large

Average

Large Small

Average

Growth Average Average Average Average

Negative Positive Negative

Composition of

fiscal policy

Spending

Mix Spending

Revenue

Spending

Revenue Mix

Other factors

Terms of trade

Neg.

Average Average Positive Average Average Average

Exchange rate

dep.

Large Small Small Small

Average Small

Small

Inflation during High

Low Low

Average Low

Low Low

Region(s)

WHD

AFR

AFR

WHD

ADV

TRANS

AFR

WHD

AFR

ADV

ASIA

AFR

MED

ASIA

Bold characters identify variables that are different from the sample mean at a five percent significance level.

So far, clusters have been described on the basis of the within-cluster averages of each

variable. But the above described characteristics as well as differences and similarities

among the clusters can also be visually summarized by plotting all the cluster averages (or

centers) against selected principal components (Figures 2 and 3).

22

The following

observations can be highlighted, bearing in mind that these are purely illustrative.

Clusters 1, 5, and 7 tend to lie in opposite portions of the charts. Cluster 1 clearly seems to

identify episodes characterized by expansionary fiscal responses with relatively unfavorable

initial fiscal and external conditions but average initial macroeconomic conditions (Figure 2,

22

These averages are calculated as averages of the factor scores for each principal components.

- 28 -

Figure 2. Distribution of Cluster Centers by Selected Factors

Fiscal response with initial fiscal, external and macroeconomic conditions

1/ Factor correlated with episodes showing fiscal response led by expenditure increases with favorable initial

fiscal balance

6

2

1

5

4

7

3

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

-1.5 -1.0 -0.5 0.0 0.5 1.0 1.5

Fiscal response 1/

1

3

6

5

2

4

7

-0.5

-0.4

-0.3

-0.2

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

-1.5 -1.0 -0.5 0.0 0.5 1.0 1.5

Initial macro conditions

Fiscal response 1/

Initial fiscal and

external conditions

- 29 -

Figure 3. Distribution of Cluster Centers by Selected Factors

Fiscal response with government size and monetary policy response

1/ Factor correlated with episodes showing fiscal response led by expenditure increases with favorable initial

fiscal balance

6

2

1

5

4

7

3

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

-1.5 -1.0 -0.5 0.0 0.5 1.0 1.5

Fiscal response 1/

7

4

2

5

6

3

1

-1.5

-1.0

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

-1.5 -1.0 -0.5 0.0 0.5 1.0 1.5

Openness, financial depth,

and monetray response

Fiscal response 1/

Government size

- 30 -

top and bottom panels). While sharing similar initial conditions, cluster 5 pursues opposite

fiscal responses. These seem to be associated with the fact that cluster 5 has on average a

larger government size (Figure 3, top panel). While showing a moderate expansionary fiscal

response, cluster 7 appears to have more favorable initial fiscal and external conditions as

compared with the other two clusters (Figure 2, top panel) but relatively unfavorable initial

macroeconomic conditions (Figure 2, bottom panel). Further, it appears to feature a more

expansionary monetary policy. However, regardless of these differences these groups seems

to be equally unsuccessful at dampening the fall in output during a recession.

Clusters 3 and 6 pursue different fiscal policies, in spite of the fact that they tend to lie on

the same portions of the charts in terms of initial conditions and accompanying monetary

policies. However, government size is much smaller in cluster 3 than in cluster 6. The

different fiscal policy responses in these groups lead, however, to similar recessions.

Cluster 2 and cluster 4 are quite similar in a number of respects. They share similar initial

unfavorable macroeconomic conditions, whereas cluster 4 has slightly more favorable fiscal

and external conditions (Figure 2, top and bottom panels). Their government sizes are below

the sample average. The most notable difference is that the fiscal response is more

contractionary in cluster 2 than in cluster 4, quite the opposite of their monetary responses.

Nonetheless, recessions appears less severe in cluster 2.

D. What Have We Learned?

As expected, when initial conditions, fiscal response and accompanying policies are

simultaneously analyzed in a multidimensional framework, the link between fiscal policy and

growth appears less clear than in the previous section. Considering the various groups that

emerged from the analysis, a number of general observations can be made.

• As indicated by the findings of the previous sections, initial conditions—fiscal,

external, and macroeconomic—are important factors in determining the effectiveness

of fiscal policy. The analysis of this section qualifies those findings by showing that it

is a combination of these initial conditions, as emerged via principal components

analysis, rather than a single condition that matters.

• Countries with large government tend to rely on fiscal expansions during a recession

more than countries with small government size. This is also consistent with the

findings of the previous section. Expansionary fiscal policy in countries with large

government appears to be associated with relatively less severe recessions. While part

of this may reflect the presence of more sophisticated fiscal systems, which are often

associated with larger automatic stabilizers, it may also reflect some endogeneity

between fiscal response and growth.

• Consistently with the findings in the previous section, fiscal expansions associated

with expenditure increases appear to be correlated with less severe recessions. This

- 31 -

seems to support the intuition that expenditure multipliers are larger than revenue

multipliers.

• Monetary policy response is linked to the depth of the recession. The episodes in

which monetary policy is contractionary have more severe recessions on average than

the whole sample, while the episodes in which monetary policy is expansionary are

associated with milder recessions. This is consistent with the results of the previous

section. There is also a moderate positive association between expansionary monetary

response and inflation during recession. As in the previous section, however, it is

difficult to disentangle whether this is the effect of monetary policy itself or the result

of a combination of factors. Irrespective of the policy response and the other initial

conditions, inflation during a recession tends to be low as long as it was low before

the episode.

• Other factors, including terms of trade shock and exchange rate devaluation, are less

of an influence on the effects of fiscal policy. In contrast to the findings in the

previous section, we do not observe a strong association between exchange rate

devaluation and fiscal policy. We also find only moderate support for the finding that

negative terms of trade shocks trigger fiscal expansions. Moreover, neither the terms

of trade shock nor the change in the exchange rate seem to have a sizeable impact on

the success of fiscal policy in restoring growth.

The above findings will be further tested in the next section by way of a standard

econometric analysis.

- 32 -

V. E

STIMATES OF A

R

EDUCED

-F

ORM

E

QUATION

A. Methodology

Based on the findings of the preceding sections, the relationship between fiscal policy and

growth during a recession is now analyzed in a standard regression framework. The

specification retained here nests the effects of the various factors examined in previous

sections (initial conditions, accompanying policies, composition of fiscal policy, and other

developments, and cluster membership) into a single reduced form equation in order to test

their joint significance.

Two models are estimated. The first model includes variables that reflect economic policy

during the recession, initial conditions, and regional dummy variables. This model can be

seen as a generalization of the descriptive approach in Section III. The second model

includes the same variables reflecting economic policy and initial conditions as model one,

but includes dummy variables for membership in the clusters instead of regional dummy

variables. Since the effectiveness of fiscal policy can be influenced by several factors, the

fiscal response is interacted with dummies for a flexible exchange rate regime, open

economies, high initial public debt, high initial fiscal deficit, expansionary monetary policy,

and the dummy variables in each model. Monetary policy is measured by the change in the

interest rate during the recession; thus a positive value indicates an expansionary monetary

policy. Initial conditions are measured by the revenue to GDP ratio before the episode, the

current account balance before the episode, and growth before the episode. Finally, regional

growth and dummies for episodes occurring in the 1970s and the 1980s are included to

capture the common external or other shocks.

23

B. Specification Search and Results

Specification strategy

For each model, the initial specification includes all variables. From this initial specification

all insignificant variables are dropped with the exception of the fiscal response and the

monetary response. Thus, all conditioning variables are identified before testing whether

fiscal and/or monetary policies influence growth during recession episodes.

In both models, all variables are jointly significant, while a large share is individually

insignificant. Since this finding is typically associated with a high degree of multicolinearity

in the regressor matrix, insignificant variables are excluded in three steps to avoid