International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024

International Journal of Research Publication and Reviews

Journal homepage: www.ijrpr.com ISSN 2582-7421

A Study of Customer Perception towards ICICI Bank Service

Dr. A. Sukumar

1

, Soma Sundaram. K

2

1

Assistant Professor, Department of Commerce with Professional Accounting, Sri Krishna Adithya College of Arts and Science

2

Student of III B.com (PA), Department of Commerce with Professional Accounting, Sri Krishna Adithya College of Arts and Science

ABSTRACT

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be

directly performed by the bank or indirectly through capital markets. ICICI Bank Limited is an Indian multinational bank and financial services company

headquartered in Mumbai with registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through a

variety of delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

INTRODUCTION

The Banking system of the country is the base of the economy and economic development of the country. It is the most leading part of the financial sector

of the country as it is responsible for more than 70 % of the funds flowing through the financial sector in the country. The banking system in the country

has three primary functions

• Operations of Payment system

• Depositor and protector of people’s savings

• Issue loans to individual and Companies

STATEMENT OF PROBLEM

• The study mainly focuses on service issues faced by customers in ICICI bank and generate new ideas in bank to satisfy customer

• To overcome the problems in ICICI banking transactions and to improve customer relationship management. Mainly to avoid server problems

in ICICI mobile application. To guide ICICI Representatives, to clearly mention the interest rates to the customers before providing home

loans.

• To overcome weakness, positive correlation between customer satisfaction and customer retention towards ICICI Bank. There is need for an

extensive study on the customer’s perceptions on the service quality in banking service offered

OBJECTIVES OF THE STUDY

• To determine the factors influencing the level of customer satisfaction in ICICI Bank.

• To assess the level of customer satisfaction on the quality of service provided by the ICICI Bank.

• To study customer preference about the ICICI Bank.

SCOPE OF STUDY

Consumers all over the world have become more quality conscious; hence there has been an increased customer demand for higher quality service.

Service operations worldwide are affected by this new wave of quality awareness and emphasis. Therefore service-based companies like the banks are

compelled to provide excellent services to their customers in order to have sustainable competitive advantage, especially in the current trend.

International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024 1792

REVIEW OF LITERATURE

A thorough literature assessment can guarantee that the right theoretical framework, research methodology, and/or research question have been selected.

More specifically, a literature review gives the reader context by placing the current work within the corpus of pertinent literature. In these situations, the

technique and results sections of the paper are typically followed by the review

• S Firdous, R Farooqui - Journal of Internet Banking and 2017 - In India, the internet banking was introduced in 1995 by ICICI bank

followed shortly. This dimension has the strongest correlation with customer satisfaction according to the analysis. To add to the existing

knowledge in the electronic banking field of study. To help the banks and policy makers have a better understanding of the internet banking

dimensions and their contributions towards customer satisfaction.

• MR Rabbani, FA Qadri, M Ishfaq - VFAST Transactions on Education and 2017 - ICICI bank from the private sector banks in the

National Capital Region (NCR). The observations covered a period from This analysis suggests that the data is highly reliable. Service quality

is one of the most important factors behind customer satisfaction in commercial banks. Various studies revealed that service quality plays a

decisive role in satisfaction of customers and satisfaction of customers to a great extent lead to the customer loyalty vis-a-vis profitability of

banks.

• N Patra, N Ray - Chaos, Complexity and Leadership 2018 Springer study aimed at finding out the crucial customer perceptions of

online/digital banking services provided by the State Bank of India. A comparative analysis of the customer ratings of the two banks.

Digitization has been introduced as a modern approach to globalization in this new era. It has been impacting on global, social, and economic

aspects. With the same vision, India has taken part in this journey to transform India into a digitally empowered society.

• D Sharma, D Aggarwal Gupta - Int. J. Sci. Technol, 2019 - by banks include Pockets (ICICI Bank) and Lime (Axis Bank) in 2015. Many

of factor analysis a descriptive study was carried out to identify factors affecting customer perception towards .The advanced mobile devices

have become popular in recent years. These devices with the developments in mobile network connectivity enable the users to explore a variety

of mobile applications. One of the most popular mobile applications is the mobile wallet or wallet. Wallets are mobile applications that provide

a variety of features to the consumers.

• R Aishwarya, D Sarala, P Muralidharan - Journal of Service 2019 - Analytics recommended huge potential of mobile banking in data are

used for the study but the analysis was made to have a basic idea for the analysis of customer perception mainly with customer satisfaction

and service quality of ICICI Bank Ltd. Mobile banking is the latest and most innovative service offered by Banks. The purpose of the study is

to investigate the determinants of service quality of mobile banking services in ICICI. Methodology: This study was conducted by using

empirical research and Cluster cum Simple random sampling method has been adopted for a sample size of 100 respondents using mobile

banking services in ICICI bank Limited.

HISTORY OF ICICI BANK

ICICI was established as a government institution on 5 January 1955, with Sir Arcot Ramasamy Mudaliar serving as its chairman. It was conceived as a

joint venture involving India's public-sector Insurance companies, banks, and the World Bank to offer project financing to Indian industry. Initially, ICICI

operated solely as a development financial institution.

In 1994, ICICI Bank was founded as a wholly-owned subsidiary of ICICI in Vadodara. Initially named the Industrial Credit and Investment Corporation

of India Bank, it later rebranded as ICICI Bank. The Boards of Directors of ICICI and ICICI Bank went ahead with a merger in October 2001 that included

two wholly owned retail finance subsidiaries: ICICI Capital

Services Limited and ICICI Personal Financial Services Limited. This merger of parent ICICI Ltd. into its subsidiary ICICI Bank led to privatisation.

During the 1990s, ICICI underwent a strategic transformation, diversifying its business from solely Offering project finance to becoming a diversified

financial services group. ICICI Bank notably launched its Internet Banking operations in 1998. In 1998, the shareholding of ICICI in ICICI Bank was

decreased to 46% through an Initial Public Offering (IPO) in India. This followed an equity provided through American depositary receipts on the NYSE

in 2000. The acquisition of the Bank of Madura Limited in an all-stock deal took place in 2001.

In 1999, ICICI became the first financial institution, bank, or Indian company from non-Japan Asia to be listed on the NYSE. Subsequently, in 2002,

ICICI, ICICI Bank, and its subsidiaries merged in a reverse merger.

Role in Indian financial infrastructure

• ICICI bank has contributed to the setting up of a number of Indian institutions to establish financial infrastructure in the country over the years:

• In 1992, India's leading financial institutions, including ICICI Ltd., promoted the National Stock Exchange of India on behalf of the

Government of India to establish a nationwide trading facility for equities, debt instruments, and hybrids, ensuring equal access to investors

across the country through an appropriate communication network.

International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024 1793

• In 1987, ICICI Ltd along with UTI set up CRISIL as India's first professional credit rating agency.

• NCDEX (National Commodities and Derivatives Exchange) was set up in 2003, by ICICI Bank Ltd, LIC, NABARD, NSE, Canara Bank,

CRISIL, Goldman Sachs, Indian Farmers Fertiliser Cooperative Limited (IFFCO) and Punjab National Bank.

• Entrepreneurship Development Institute of India (EDII), was set up in 1983, by the erstwhile apex financial institutions like IDBI, ICICI, IFCI

and SBI with the support of the Government of Gujarat as a national resource organisation committed to entrepreneurship development,

education, training and research.

• Eastern Development Finance Corporation (NEDFI) was promoted by national-level financial institutions like ICICI Ltd in 1995 at Guwahati,

Assam for the development of industries, infrastructure, animal husbandry, Agri-horticulture plantation, medicinal plants, sericulture,

aquaculture, poultry and dairy in the North Eastern states of India.

Here are some essential details about the ICICI bank:

PARTICULARS

Type

Public

Industry

Banking, Financial services

Founded

5 January 1994; 26 years ago,

Area

served Worldwide

Key people

Girish Chandra Chaturvedi (Chairman), Sandeep Bakhshi (MD & CEO)

Products

Retail banking, corporate banking, investment banking, mortgage loans, private

banking, Wealth Management, credit cards, finance and insurance

Net profit records

Rs. 9,648crore

Market Capitalisation

Rs. 7.44 trillion (US $7441.43 billion) (2024)

Revenue

Rs. 59,739.72 crore

Net Income

Rs. 34,036.64 crores (US$4.3 billion) (2023)

Total assets

Rs. 19.58 lakh crores

Number of employees

1,30,542

DATA ANALYSIS AND INTERPRETATION

Analysis and interpretation of data are two key components in the process of understanding information gathered through research or observation

SIMPLE PERCENTAGE ANALYSIS

Simple Percentage method refers to the specific kind which is used in making comparison between two or more series of data collected. Percentages are

based on descriptive relationship. It compares the relative items. Through the use of percentage, the data are reduced in the form with base equal to 100%,

which facilitate relative comparison.

International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024 1794

FORMULA:

PERCENTAGE = NO.OF. RESPONDENTS X100

TOTAL NO.OF. RESPONDENTS

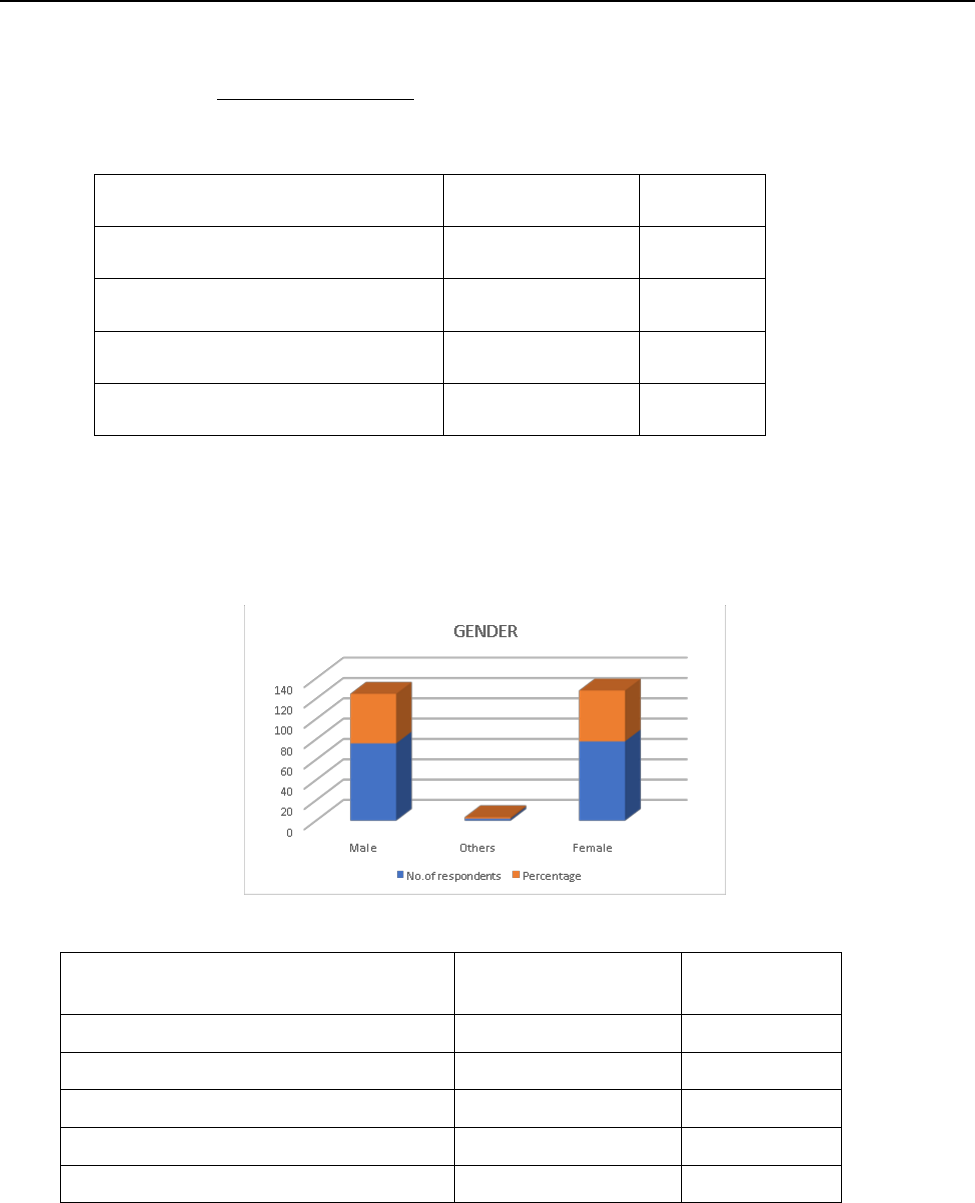

TABLE SHOWING GENDER OF RESPONDENTS

Gender

No. of respondents

Percentage

Male

76

48.7

Others

2

1.3

Female

78

50

Total

156

100

SOURCE: PRIMARY DATA

INTERPRETATION :+

The above table shows the 50% of the respondents are female,48.7% of the respondents are male and 1.3% of respondents are others. Hence the highest

respondents are female.

CHAT SHOWING GENDER OF RESPONDENTS

TABLE SHOWING HOW WOULD YOU RATE THE EFFICIENCY OF ICICI BANK ONLINE BANKING PLATFORM

How would you rate the efficiency of ICICI bank

online banking platform

No.of respondents

Percentage

Excellent

69

44.2

Good

56

35.9

Fair

19

12.2

Poor

12

7.7

Total

156

100

SOURCE: PRIMARY DATA

INTERPRETATION :

This above table shows 44.2% of the respondents are excellent, 35.9% of the respondents are good, 12.2% of the respondents are fair, 7.7% of the

respondents are poor.

Hence the highest respondents mention that the ICICI service is excellent.

CHART SHOWING THE RATE OF EFFICIENCY IN ICICI BANK ONLINE

BANKING PLATFORM

International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024 1795

WEIGHTED AVERAGE METHOD

A weighted average is a type of mean that gives differing importance to the values in a dataset. In contrast, the regular average, or arithmetic mean, gives

equal weight to all observations. The weighted average is also known as the weighted mean, and I’ll use those terms interchangeably.

Use a weighted mean when you must consider the relative significance of values in a dataset.

In other words, you’re placing different weights on the values in the calculations

TABLE SHOWING CUSTOMERS TOWARS TOWARDS ICICI BANK

Rating

Highly

satisfied

Satisfied

Neutral

Dissatisfied

TOTAL

WEIGHTED

AVERAGE

RANK

Efficiency of ICICI banking

online banking platform

120

186

80

25

411

2.61

4

Overall services provided by

ICICI bank

200

120

74

30

424

2.70

3

Competitive interest rate

and fees compared to other

bank

272

96

50

32

450

2.86

2

Bank app interface

320

132

60

3

515

3.28

1

INTERPRETATION:

In the view to find out the satisfaction level of the customers, the qualitative need to converted the quantitative data, for that purpose different weightage

was given to the different agreed levels, namely highly satisfied given with 4, satisfied given with 3, neutral given with 2 and dissatisfied given with 1

The above table depicts that ‘customers satisfaction towards ICICI banking services’ was given with bank app interface in the weighted average of 3.28,

and marked as rank 1, competitive interest rate and fees compared to other bank in the weighted average of 2.86, and marked as rank 2, overall services

provided by ICICI bank in the weighted average of 2.70, and marked as rank 3, online banking platform in the weighted average of 2.61, and marked as

rank 4

Findings :

This study intends to investigate how customers are satisfied with ICICI bank services as well as to point the customer expectations and perception . It is

evaluated in the general level of banking service analysis in Coimbatore city using a number of analytical methods including simple percentage analysis

and weighted average method. A summary of the study’s findings suggestions and conclusion based on them are given in final chapter.

Percentage Analysis

50% of the respondents are female.

37.2% of the respondents belongs to the age group are 18-25.

51.3% of the respondents are belongs employment level are UG.

52.6% of respondents are belongs to the monthly income is below 20000.

International Journal of Research Publication and Reviews, Vol 5, no 5, pp 1791-1796 May 2024 1796

44.2% of the respondents are belongs to area of residency in urban area.

57.7% of the respondents are belongs to nuclear family

33.3% of the respondents are belongs to less than a year.

44.2% of the respondents are agree the banking service of ICICI is excellent

71.8% of the respondents are using savings account

48.1% of the respondents are satisfied with the service quality.

44.2% of the respondents are agreeing the ICICI bank offers. 44.9% of the respondents are using their ICICI bank account weekly

35.9% of the respondents are using ICICI customer service.

51.9% of the respondents are using customer service

50.6% of the respondents are agree the problem of ICICIC bank service will solve within a week

Weighted average

3.28 Weighted average respondents were satisfied with the banking inter face app services.

CONCLUSIONS

Overall Satisfaction the majority of customers express satisfaction with ICICI Bank's services, indicating that the bank is meeting or exceeding their

expectations in various aspects. Service quality customers value the quality of services provided by ICICI Bank, including the efficiency of transactions,

reliability of banking systems, and the competence of staff. Convenience is a significant factor influencing customer satisfaction, with customers

appreciating the accessibility of branches, ATMs, online banking platforms, and mobile banking apps offered by ICICI Bank. Communication and

Responsiveness Effective communication and responsiveness to customer queries, complaints, and feedback contribute positively to customer

satisfaction, indica.

BIBLIOGRAPHY

REFERNCE

• J Agarwal - journal of computing and business research, 2012 -the customer satisfaction through service quality provided by the banks- SBI

from the public sector banking and ICICI of the study.

• S Firdous, R Farooqui - Journal of Internet Banking and 2017- In India, the internet banking was introduced in 1995 by ICICI bank followed

shortly. This dimension has the strongest correlation with customer satisfaction according to the analysis

• MR Rabbani, FA Qadri, M Ishfaq - VFAST Transactions on Education and 2017 - ICICI bank from the private sector banks in the National

Capital Region (NCR).

• N Patra, N Ray - Chaos, Complexity and Leadership 2018: Springer study aimed at finding out the crucial customer perceptions of online/digital

banking services provided by the State Bank of India

• D Sharma, D Aggarwal Gupta - Int. J. Sci. Technol, 2019 - by banks include Pockets and Lime in 2015. Many of factor analysis a descriptive

study was carried out to identify factors affecting customer perception towards

• S Singh - Think India Journal, 2019 - that the respondents opinion is concentrated towards satisfaction level. Thus, it is concluded from the

above analysis that the services of the ICICI Bank

• HM Bai - Shan lax International Journal of Commerce, 2019 - This review shows that to fulfil the expectations of the consumers and to increase

the study came to know that ICICI bank is providing good mobile banking services to its customers

WEBSITES:

• https://www.google.com

• wikipedia.org/wiki/ICICIBank

• www.icicibank.com