Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

7

Mobile Banking Services and

Customer Satisfaction with

Reference to ICICI Bank -

A Study

H.Manjula Bai

Faculty Member, Department of Post Graduate Studies and Research in Commerce

Kuvempu University, Shankaragatta, Karnataka, India

Abstract

This paper is designed to study the extent of the recent developments in themobile banking system in

India., to know the optimistic and pessimistic inuence of mobile banking on the customers of ICICI

bank. For the purpose of study, the researcher has selected 50 respondents who have familiar with

the modern technology of mobile banking. It particularly focused on the problems or the benets

availed from the mobile banking provided by ICICI bank. All levels of customers were surveyed

by using questionnaire and the level of satisfaction or dissatisfaction from the mobile banking was

studied. Finally the detail information about the benets they had received were also considered.

A small attempt have been made to understand the benets of the mobile banking and also the

limitation of mobile banking was studied with reference to ICICI Bank. Finally, it makes an attempt

to offer suggestions to the bank to educate much more about mobile banking to its customer.

Keywords: E-banking, EFT, ATMs, Mobile banking, Internet banking, Electronic Clearing

Services [ECS], Credit Cards

Introduction

The Banking sector is the lifeline of any modern economy. It is one of the

important nancial pillars of the nancial sector, which plays a vital role on the

functioning of an economy. It is very important for economic development of a

country that its nance requirements of trade, industry and agriculture are met

with higher degree of commitment and responsibility. Thus, the development

of a country is integrally linked with the development of banking.

A bank is a nancial intermediary and money creator that create money by

lending money to a borrower, thereby creating a corresponding deposit on the

bank’s balance sheet. Lending activities can be performed directly by loaning

or indirectly through capital markets.

Banks felt the need to upgrade their customer service to much higher plan

in order to survive in this competitive environment. They found technology

as an ideal tool to achieving this objective. Public sector banks were guided

by the recommendations of the committee for the up-gradation of banking

technology. Though the pace of the computerization has been moderate, the

manner in which public sector banks went in for investments in technology was

enough proof of the belief the banks have on technology to secure their future.

Till 1980, banks had only one delivery channel which is the branch presence.

OPEN ACCESS

Volume: 7

Issue: 2

Month: April

Year: 2019

ISSN: 2320-4168

Received: 11.03.2019

Accepted: 30.03.2019

Published: 01.04.2019

Citation:

Manjula Bai, H. “Mobile

Banking Services and

Customer Satisfaction

with Reference to

ICICI Bank - A Study.”

Shanlax International

Journal of Commerce,

vol. 7, no. 2, 2019,

pp. 7–18.

DOI:

https://doi.org/10.34293/

commerce.v7i2.345

This work is licensed

under a Creative

Commons Attribution-

NonCommercial-

NoDerivatives 4.0

International License

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

8

Suddenly, technology has opened up options

for various delivery channels. Technology-aided

products like ATMs, point of sale devices, anywhere

banking, smart cards and internetbanking, has given

the customers to choose his channel of getting

catered to his requirements consequently, and the

bank should also have channel- based strategy to

serve the customers. Over the years, technology has

brought a sea change in the functioning of the banks.

In modern days banks provide a variety of

products and services to the customers. Apart from

regular banking activities, they provide telebanking

and e-banking and mobile banking services, offer

insurance products, mutual fund schemes and etc.

The various services offered by the banks can be

united by the customers only when they are made

aware of these services. Mobile phones have becomes

an integral part of the 21st_century landscape with

an expected penetration of 4.5 billion by 2011.

Indeveloping countries, the role of the mobile phone

is more extensive than in developed countries as it

helps bridge the digital divide.

The mobile phone is the one device that people

already carry at all time and service beyond voice and

text messaging are booming all over the globe. The

main reason that mobile banking scores over internet

banking is that it enables ‘Anywhere Banking’

customer now don’t need access to a computer

terminal to access their banks. They can now do so

on the go when they are waiting for their bus to work,

when they are travelling or when they are waiting for

their orders to come through in a restaurant.

Mobile banking are supported by these services

a) Account balance inquiry

b) Cheque status inquiry

c) Account statement inquiry

d) Fund transfer between Accounts

e) Cheque book requests

f) Credit/debit alerts

g) Minimum balance alerts

h) Bill payment alerts

i) Recent transaction literacy

j) Bill payment

The rapid growth in users and wider coverage

of mobile phone networks have made this medium

a platform for extending banking services to

customers.

Technology has revolutionized all the aspects of

our life and even the banking sector is no execution

from computerization to networking, to internet

banking and now mobile banking, the banks have

advanced with time and are providing more and more

new form of services which are not only convenient

to customer but also provide competitive edge to

the banks. With mobile technology banks can offer

a wide range of services to their customer such

as doing fund transfers purchasing stocks access

to account information etc. This is called mobile

banking or M-banking.

The banker and customer have to know about one

another. The banker has to understand the customer’s

needs and in the same way the customer has to know

about the various services offered by the banks and

it increased level of awareness among the customers.

So in the light of the above, this studyattempted to

know about the pros and cons of mobile banking

services.

Review of Literature

Krassie Petrova, made a study on “Mobile

Banking background, services and adoption,

he stated that, a new communication technology is

redening the convergence of telecommunication

and computing. Mobile banking has emerged as

a possible powerful provider of bundled banking

services. New platforms and protocols are being

developed able to create and support a seamless and

truly global service platform. The mass adoption

of mobile banking will depend on the provision

of secure, reliable and easy to customize user

interfaces. Paper examines some relevant standards

and protocols for mobile banking and discusses

mobile banking services and their adoption within a

conceptual framework.

Rahamathsana, Hema Date, Abdullah

Kammani, and ‘Niserhundewale’, they made

a study on, Technology adoption and Indian

consumers: study on mobile banking, they stated

that, information technology is consider as the key

driver for the changes taking place around the world.

Mobile banking is the latest and most innovative

services afford by the banks. The transformation

from the traditional banking to E-banking has

been a ‘leap’ change. The evolution of E-banking

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

9

started from the use of Automatic Teller Machine

(ATM) and telephone banking (Tele banking),

direct bill payment, electronic fund transfer, and the

revolutionary online banking. This study determines

the consumer perspective on mobile banking

adoption.

D. Vanisree, made a study on Mobile Banking

in India: Barriers in adoption and service

preferences, she stated that Mobile banking yet

there are numbers of issues and threats in Mobile

banking system and the major problem of mobile

banking customer inuence of demographic variable

on mobile banking services adoption. A cross-

section descriptive design was adopted and data

collected was subject to product moment correlation.

She also stated that the customer’s security concern

is the major barrier in adopting mobile banking

services. As for as preferred services are concern

balance check tops, as customer prefer information

based services rather than nancial services provided

by the bank.

Jonathan Donner made a study on Mobile

Banking and Economic Development: linking

adoption, impact, and use, he stated that, various

initiatives use the mobile phone to provide nancial

services to those without accesses traditional banks.

Yet relatively little scholarly research explores

the use of these m-banking/m payments systems.

Presenting illustrative data from explanatory work

with small enterprises in urban India, it argues that

contextual research is a critical input to effective

“adoption” or “impact” research. She also stated

that the challenges of linking studies of use to

those of adoption and impact reect established

and communication technologies and development

research community.

Jadav Anil (2004), made a study on Status of

E-banking in India, described various channels

of e-banking services such as ATM, Telephone

Banking, Mobile Banking, internet banking and

its features. The focus is also given on e-banking

opportunities, challenges and security aspects while

performing the banking transaction on the internet.

Comparison of public, foreign and co-operative

banks and barriers to the growth of e-banking in

India are also discussed. Finally the paper discusses

an overview of the major private sector banks such

as ICICI, HDFC, IDBI and UTI banks provides

e-banking services.

Ranjuchaandran, made a study on “Pros and

cons of Mobile Banking”. Mobile Banking refers to

provision of banking and nancial services with the

help of mobile telecommunication devices. After the

launch of Mobile Banking in India, mobile banking

transactions have seen some growth. Majority of

customers prefer banking in traditional ways. The

basic objective is to identify the advantages and

limitations of mobile banking and the problems

faced by customers in mobile banking.

He also stated that, Banking Apps can make bill

paying and bank account management incredibly

convenient. But the risk of identity theft is a major

downside. Fortunately, it’s easy to avoid most of

the pitfalls with commonsense solutions like strong

password protection and secure connections. By

keeping these security tips in mind, we can enjoy a

safer Mobile banking experience.

Devadevan, made a study on “Mobile banking

in India-Issues and challenges” he stated that,

Technology plays an important role in banking.

Mobile banking is an emerging alternate channel

for banking institution. The rapid technology

development in mobile technology like 2G, 3G, and

4G has become matrix challenges for banks. It is

visible that the bank which started mobile banking in

the form of SMS banking, then adopted application

(software) based model for tradition mobile handsets,

the evaluation of smart phones, mobile operating

system and Mobile Apps posed the banks to adopt

the current technology. The customers are mostly

using ATM and online banking services. Most of the

customers feel comfortable without mobile banking.

They also feel, there are chances of misuse in mobile

banking due to mobile handset theft.

Nitin Nayak, Vikas Nath, Nancy Goel, they

made a study on “A study of Adoption behavior

of mobile banking services by Indian consumers”.

They are stated that, recent innovations in the

telecommunication have proven to be a boon for the

e-banking sector and its customers: one of these is

Mobile Banking, where customers interact with the

bank via mobile phones. This review shows that

to fulll the expectations of the consumers and to

increase the mobile banking users, mobile banking

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

10

service provider needs to increase the awareness

about the mobile banking services.

Sunil, kumar Mishra and Durga Prasad sahoo,

they made a study on “Mobile Banking adoption on

and Benet towards customer’s service.” They are

stated that, In order to achieve the goals of business,

various channel of communications to customers

have to be developed through technology.

Mobile banking is considered a new era in banking,

in which banks are spending considerable amount of

money to have it available to their customers and to

cut their operations costs. Unfortunately, evidence

have shown that some number of customers do not

use mobile banking for various reasons, despite its

benets.

Statement of Problem

The position of banking industry is not excellent

in India. In 2011, 65% of India’s population

did not have access to a bank account. The lots

of Indian population till date do not have their

personal bank accounts. RBI also requested to the

members of the country, each person has minimum

one saving account in any bank of India. But still

there is lack of awareness in the people. So mobile

banking is a good option for the banking industry to

increase their customers. With the help of mobile

telecommunication technology customers make

numerous transactions in the bank at any time.

There are many researchers which show that India is

moving fast towards mobile users as well as mobile

internet users which is also bigger strength to the

banking industry to promote Mobile Banking. But

this Mobile Banking system has certain drawbacks.,

such as lack of awareness, transaction cost, security

issue, difculty to understand, sometimes the

information available is not accurate. Because of

this, many customers are not using it. So a detail

information about the benets they receive are

considered and a small attempt has been made to

understand the benets of the mobile banking and

also the limitation of mobile banking with reference

to ICICI Bank. Finally, it makes an attempt to offer

suggestions to the bank to educate much more about

mobile banking to its customer.

Objectives of the Study

1. To know about the role of Mobile Banking in

Modern days.

2. To study about the Mobile Banking services and

other modern services provided by the ICICI

Bank.

3. To study about the factors that inuenced the

customers to use mobile banking.

4. To study the benets and limitations of Mobile

Banking.

5. To see the future prospects of mobile banking in

India.

6. To nd out the facilities that are provided by

Mobile Banking services.

7. To study the Mobile banking services used by

worldwide.

8. To offer some suitable suggestions for the

improvement of Mobile Banking.

Scope of the Study

It covers the mobile banking silent feature, its

impact on customer’s progress. The scope of the

study is restricted to Branches of ICICI in Shimoga

only .The study is conrmed to the period 2018-2019

Research Methodology

For the purpose of study data is collected in two

ways one is primary and other is secondary.

Primary Data

Primary data is collected by distributing

questioners to the respondents and by conducting

personnel interview. The questioners were

distributed to the students and graduates,but personal

interview was conducted for some who did not ll

the questionnaire.

Secondary Data

Secondary data is collected from various articles,

newspapers, magazines, and websites.

Sample Size

A total number of 50 respondents are selected for

the purpose of collecting information on the study

and convenience sampling method has been selected.

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

11

Tools of Analysis

The collected data has been analyzed with the

help of percentage and interpreted through various

gures.

Limitations of the Study

The present study is not free from limitations.

Same of the important limitations of this study are

pointed out as follows.

1) Lack of proper co-ordination from the

respondents.

2) Lack of proper communication with the

respondents.

3) Lack of time.

4) Biased response from the respondents.

Many of the respondents felt that the information

they gave, would be circulated and did not feel easy.

But the researcher after convincing them, was able to

get the information.

Concept of Mobile Banking

Mobile banking is an electronic system that

provides most of the basic services through the smart

phone. Mobile banking comes in as a pan of the

banks initiative to offer multiple channels banking

providing convenience for its customer. Mobile

phones are playing great role in Indian banking –

both directly and indirectly. There are being used

both as banking and other channels.

Meaning of Mobile Banking

The term mobile banking refers to the use of

mobile as a channel of offering and delivering

banking services which includes traditional services

such as funds transfer as well as new services such

online and electronic payments. In fact, Mobile

banking is dened as doing bank transactions via

mobile phone. Mobile banking services in India will

continue to grow so that economic experts forecast

that by 2013. Three hundred billion transactions

worth more than 860 billion dollars will be done

through mobile banking.

Characteristics of Mobile Banking

Mobile banking has become increasingly popular

over the years. Banks offer mobile banking services

to their clients as a convenience. Here are some

features to consider with mobile banking.

Saving Money

Many banks use the savings generated from

online transactions to offer clients better interest

rates, or other rewards, for maintaining online

accounts.

Saving the Environment

Mobile banking reduces the number of paper

transactions. Reduced paper use helps preserve

natural resources and is better for the environment.

Convenience

Mobile banking is certainly more convenient

when compared to calling a bank or physically

visiting it. Financial transactions can be performed

at any time; day or night and during holidays.

Simplicity

Clients can set up instant bill payment and

automate other tasks via mobile banking. This

simplies bill payment and frees the client from

spending time on writing checks and mailing

envelops.

Security

Mobile banking can be plagued with security

concerns. Though bit is rare, hackers have been

known to gain access to client accounts, banks

have become increasingly vigilant about securing

additional passwords or answers to security

questions.

Account Notification

Most banks will email notications to their

clients when a bill is due or when an account

statement is available. This helps the client remember

bill payment and other such items before they are

overdue.

Growth of Mobile Banking in India

The business drivers contributed to the growth of

mobile banking over various modes of operation.

SMS Alerts

One of the key concerns banks were facing was

that of customers did several inquiry transactions

on ATMs and this was adding to the burden on the

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

12

ATM infrastructure. This trafc was particularly

heavy during salary days. Banks adopted a solution

of proactively. Communicating account balances

and important transactional activity on accounts

to customers through a simple SMS. Customers

stopped queuing up in front of ATMs for inquiry

transactions.

Account Inquiries

The SMS technology proved simple enough for

banks to adopt this as a self-service channel. This

model of option involved customers sending an SMS

to a published number of the bank with keyword and

identication information. The customer experience

for SMS based inquires was not very good and this

led to the introduction of real time communication

channels such as WAP and USSD

Fund Transfer and Bill Payment

As customers experience from mobile banking

improved. Banks began to realize the potential of

offering nancial transactions through the mobile

device. The rst set of transactions to be offered were

fund transfer between the customers own accounts

and payments to pre-designated billers such as utility

companies. These facilities vastly reduced the use of

cheques, hence contributing to the cost benet for

banks.

Payment Services

The mobile phone was unique in that it was

a personal device which had computation power,

storage ability and occupied a greater mind-share of

the customer than the traditional money wallet. This

triggered new thoughts among bankers who wanted

to leverage these capabilities to offer newer set of

transactions on the mobile phone. This came in the

form of enabling payment transactions through the

mobile phone.

Loan Requests and Service Requests

As mobile phones evolve into smart phones and

the usability is improving, banks are nding it easier

to offer more complex services on the mobile phone.

The latest trends include offering loans through

requests placed from the mobile phone were pre-

registered customers can provide details about the

loans and avail instant approval of loans. Mobile

banking progressed to offer enhanced customer

experience and adopt the latest technology trends in

communication to offer real time exchange of data.

Mobile Banking Services

Mobile banking services means providing all

banking services or facilities to users through mobile

device by bankers. Mobile banking services includes

making various payments, paying bills, various

enquiries, checking various accounts, fund transfer,

enquiry on ATM, balances, SMS services etc. are

called mobile banking services.

Service Features

Mobile banking users can perform the following

banking operations

• Subscribe to the mobile banking services at their

nancial institution and cancel their subscription

at any time.

• Add or remove a bank account from a list of

available accounts managed through mobile

service

• Simulate transaction in order to try the system.

• Verify the balance of their bank account.

• View the most recent transactions on their bank

accounts

• Accounts managed through mobile banking

• Check the amount of credit available on their

credit cards.

• Obtain cash advances on their credit card

accounts

• Recharge their pre-paid mobile accounts

• Pay utility bills, such as electricity, or any other

bill that that can be registered with the nancial

institution.

• Pay other services through reference numbers

found on the bills.

• Add or remove a credit card account from the

list of available transfer funds between different

accounts.

• Transferfunds between different accounts

including to another customers account, or an

account in a different bank.

• Mobile wallet (stored value account)

One way to classify these services depending

on the originator of a service session is the “Push/

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

13

Pull” nature. ‘Push’ is when the bank sends out

information based upon an agreed set of rules, for

example your banks sends out an alert when your

account balance goes below a threshold level. ‘Pull’

is when the customer explicitly requests service

information from the bank, so a request for your last

ve transactions statement is a Pull based offering.

The other way to categorize the mobile banking

services, by the nature of the service, give us two kind

of services- Transaction based and Enquiry Based.

So a request for your bank statement is an Enquiry

based service and a request for your fund’s transfer

to some other account is a transaction-based service.

Transaction based services are also differentiated

from enquiry based services in the sense that they

require additional security across the channel from

the mobile phone to the banks data services.

Problems of Customer of Mobile Banking

• Not sure about the safety of transactions

• Mobile security

• Network availability

• Heavy charges for transactions

• Email and web security

• Literacy of people in rural areas

• Not aware of new innovation

• Handset operate ability

• Inadequate guidance

• Identity theft

Advantages of Mobile Banking

Mobile banking through cell phone offers many

advantages for customers as well as banks. Some of

them are as follows.

To Customers

• Customers need not stand at the bank counter

or front ofce for various enquiries about their

account.

• Customers can save their valuable time and

traveling cost in reaching the bank for their

nancial transactions.

• It is a mobile service to have information, all

the 365 days, anytime, anywhere, about their

account.

• Customers can pay their utility bills on time and

save their selves from paying penalties, since

alerts are received from the bank.

• Cheese book request can be made sitting at their

work place.

• Customer can transfer money instantly to another

account in the same bank using mobile banking.

To Bankers

• Bankers can utilize the time saved by the channel

migration of customers to mobile banking for

expansion of business through better marketing

and sales activities.

• Mobile banking enables banks to reduce cost of

courier, communication, paper works etc.

• Bank can be in touch with their clients with

mobile banking.

• Banks can also promote and sell their products

and services like credit cards, loans etc. to a

specic group of customers.

• This new channel gives the bank ability to cross-

sell up-sell their other complex banking products

and services such as vehicle loans, credit cards

etc.

• Mobile banking through cell phone is very

advantageous to the banks as it serves as a guide

in order to help the banks improve their customer

care services.

• Mobile banking through cell phone is user

friendly. The interface is also very simple. It

just need to follow the instructions to make

the transaction. It also saves the record of any

transactions made.

• Banking through mobile reduces the risk of

fraud. Customer will get on SMS whenever

there is an activity in our account. This includes

deposits, cash withdrawals, funds transfer etc.

customer will get a notice as soon as any amount

is deducted or deposited in our account

Disadvantages of Mobile Banking

• Mobile banking users are risk of receiving fake

and scams

• The loss of a person’s mobile device often means

that criminal can gain access to the mobile

banking PIN and other sensitive information.

• Modern mobile devices like smartphones and

tablets are better suited for mobile banking than

old models of mobile phones and device

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

14

• Regular users of mobile banking over time can

accumulate signicant charges from their banks.

• Most mobile banking apps need an internet

connection to be able to operate. So if you live

in a rural area or experience problems with your

internet connection, then you won’t be able to

access your account. the same applies if your

mobile phone runs out of battery

• Security

• Most people have not enough idea about mobile

banking yet

• Mobile banking is being used for fund transfer

mainly, customer does not keep deposit for long

duration.

• The data is transferring through a third party

cellular network, so there is a security thread.

• The most prominent issue faced is security of

the account information stored on the mobile

devices.

Analysis and Interpretation

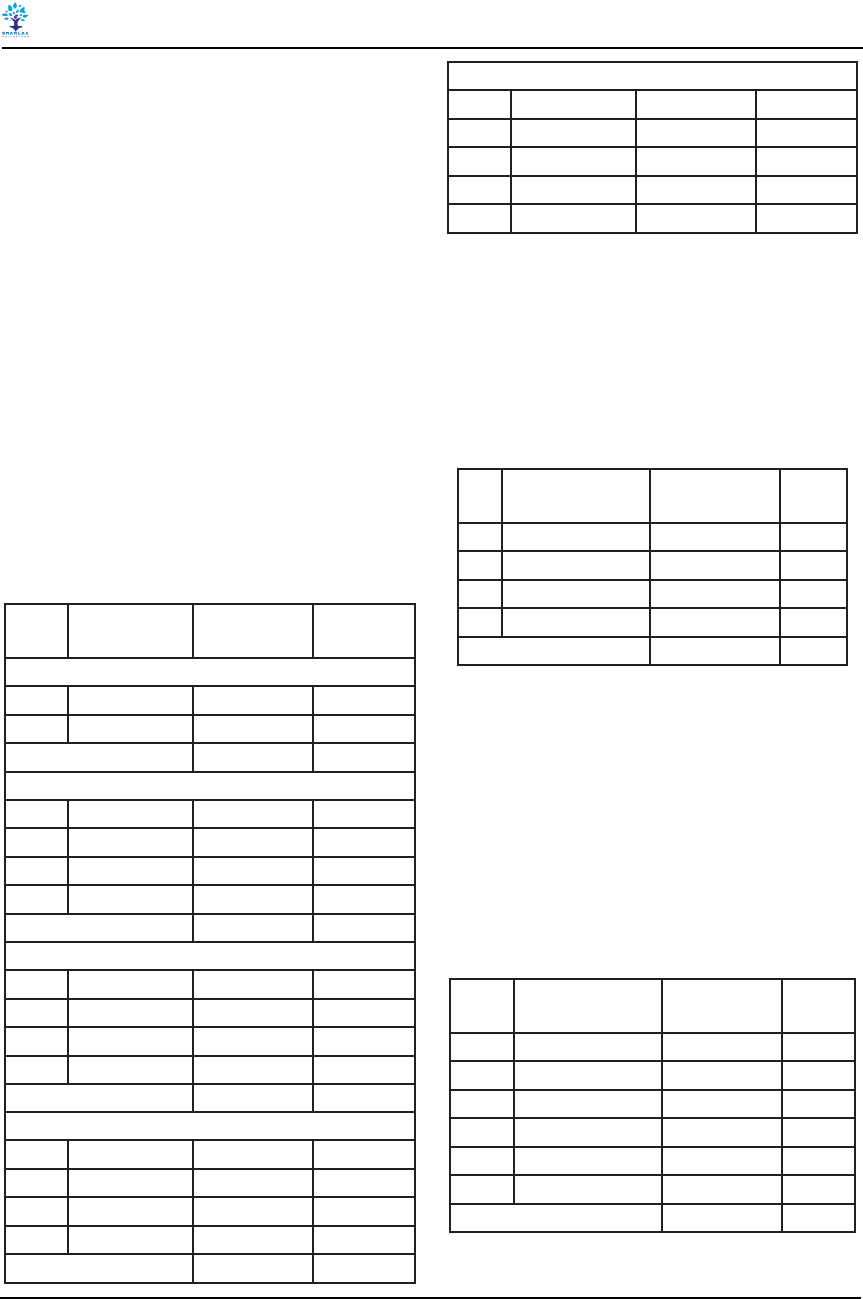

S. No Particulars

No. of

respondents

(%)

Gender

1 Male 30 60

2 Female 20 40

Total 50 100

Age (years)

1 Below 25 25 50

2 26-40 17 34

3 41-55 08 16

4 Above 55 00 00

Total 50 100

Educational qualication

1 SSLC 05 10

2 PUC 06 12

3 Graduate 15 30

4 Post Graduate 24 48

Total 50 100

Occupation

1 Student 21 42

2 Businessman 06 12

3 Employee 19 38

4 others 04 08

Total 50 100

Monthly Income

1 Below 15000 18 36

2 15000-25000 17 34

3 25000-35000 12 24

4 Above 35000 03 06

Total 50 100

From the above data it is clear that majority of

the respondents who are using the services of mobile

banking are male of the age group below 25 and are

students and employees who are graduates and their

monthly income is below 15000.

Classification of respondents on the basis of factor

influenced about mobile banking service.

S.

No

Particulars

No. of

respondents

(%)

1 Quality of service 17 34

2 Technology use 11 22

3 Trust 19 38

4 Location 03 06

Total 50 100

Source: survey result

From the above table it is clear that, out of 50

respondents, 38% of respondents have preferred trust

based service, 34% of respondents have preferred

quality service and 22% of respondents have

preferred technology based service and remaining

6% of respondents have preferred location based

service. This shows that, majority of the respondents

have given importance to trust and quality service.

Classification of respondents on the basis of usage

of modern technology

S. No Particulars

No. of

respondents

(%)

1 Mobile Banking 20 40

2 Tele Banking 02 04

3 Internet Banking 05 10

4 Credit Card 02 04

5 ATM 20 40

6 EFT 01 02

Total 50 100

Source: survey result

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

15

From the above table it is clear that, among 50

respondents, 40% of respondents prefer mobile

banking, 40% of respondents prefer ATM services,

and 10% of respondents prefer internet banking,

4% of respondents prefer credit card and 4% of

respondents prefer Tele banking.

This shows that, all the respondents prefer

mobile banking services especially ATM and mobile

banking because these services are easily accessible

for all most all the customer.

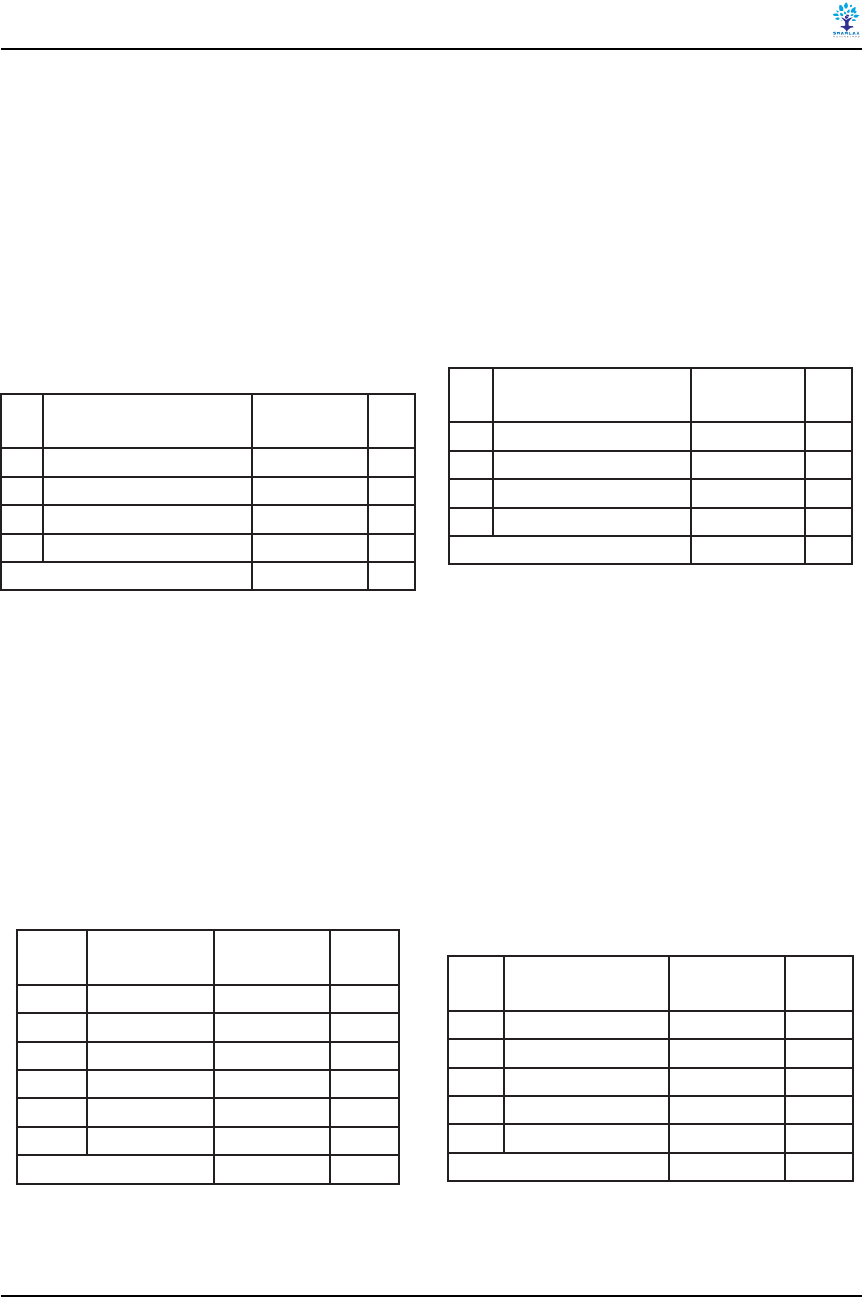

Classification of respondents on the basis of

reason for not access Mobile Banking services

S.

No

particulars

No. of

respondents

(%)

1 I don’t have Mobile phone 00 00

2 Not aware of the service 03 30

3 I don’t trust this service 04 40

4 I’ll register sometime later 03 30

Total 10 100

Source: survey result

From the above table it is clear that, 10

respondents did not accessed mobile banking service,

4 respondent don’t trust on this service, 3 respondent

are not aware about this service and 3 respondent

opinion that they would register after some time.

This shows that, very less number of customers

of the bank are not using mobile banking service

because they are not aware about it and have less

trust on this service.

Classification of respondents on the basis of

purposes of using Mobile Banking services

S. No Particulars

No. of

respondents

(%)

1 Deposit 08 20

2 Withdrawal 04 10

3 Money transfer 16 40

4 Payment 02 05

5 Saving 02 05

6 Purchasing 08 20

Total

40 100

Source: survey result

From the above table it is clear that, among 40

responses, 40% of respondents are using money

transfer services in mobile banking, 20% of

respondents are using for deposit purpose, also 20%

of respondents are using for purchasing purpose,

10% of respondents are using for withdrawal

purpose, where as 5% respondents are using for

saving purpose, and remaining 5% of respondents

are using for payment purpose.

This show that majority of them are using mobile

banking for money transfer because it’s very easy

and convenient.

Classification of respondents on the basis of

opinion about mobile Banking service

S.

No

Particulars

No. of

respondents

(%)

1 Simple 16 40

2 Easy to Use 20 50

3 Difcult to Use 02 05

4 Need for usage Training 02 05

Total 40 100

Source: survey result

From the above table it is clear that, out of 50

respondents, 40 respondents are using mobile

banking services, 50% respondents have felt that it

is easy to use, 40% respondents have felt that it is

simple, 5% respondents have felt that it is difcult to

use, and remain 5% respondents have felt that need

for usage training.

This shows that, majority of them are felt that

mobile banking is easy to use because the procedure

for usage of mobile banking is very easy and

understandable one.

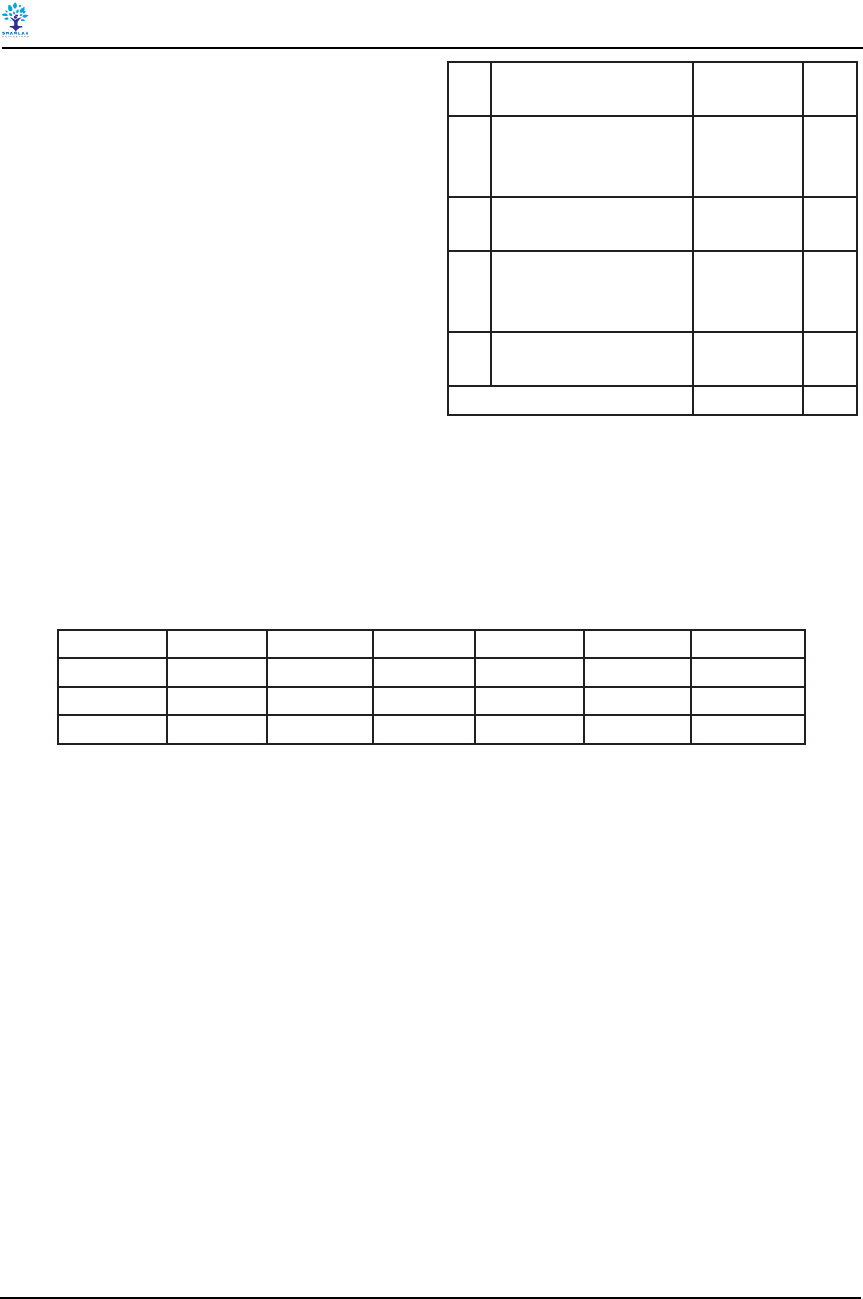

Classification of respondents based on satisfaction

level about use of mobile banking services

S.

No

Particulars

No. of

respondents

(%)

1 Highly satised 06 15

2 Satised 20 50

3 Average 10 25

4 Dissatised 04 10

Highly Dissatised 00 00

Total 40 100

Source: survey result

From the above table it is clear that, out of 50

respondents, 40 respondents are using mobile

banking service, 50% respondents have felt that it is

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

16

satised, 25% respondents have felt that it is average

and 15% of respondents have felt that it is highly

satised, remaining 10% of respondents have felt

that it is dissatised.

This shows that, majority of the respondents are

satised with mobile banking service.

Classification of respondents based on problems

faced by usage of mobile banking services

From the below table, it is clear that, out of 50

respondents, 40 respondents are using mobile banking

services, 45% of respondents have felt that there is

sometimes technical problem during transactions,

25% of respondents have felt that there is fear about

security of the transaction, 20% of respondents have

felt that there is No direct communication and 10%

of respondents have felt that there is limited scope

for personal advice on banking transactions.

This shows that, majority of the respondents have

felt that mobile banking service have some problem

for transactions and security problems

S.

No

Particulars

No. of

respondents

(%)

1

Limited scope for

personal advice on

banking transactions

04 10

2

No direct communication

with bank

08 20

3

Sometimes technical

problem during

transaction

18 45

4

Fear about security of the

transactions

10 25

Total 40 100

Test Application

Chi square Test

H

0

: Educationis not signicant for the use of

mobile banking

H

1

: Education is signicant for the use of mobile

banking

Responses Observed Expected (O-E) (O-E)^2 (O-E)^2/E Values

Agree 30 15 15 225 225/15 15

Disagree 40 45 -5 25 25/45 0.55

Neutral 30 40 -10 100 100/40 2.5

Calculated Value = 18.05; Degree of freedom n-1 i.e. 3-1=2

Table value of chi square for 2 degree of freedom @ 5% level of signicance is 5.99

Since the calculated value is more than the table

value, Null hypothesis is rejected. Hence alternative

hypothesis is accepted .Hence proved that Education

is signicant for the use of mobile banking.

Findings

Following are the major ndings extracted from

the analysis:

• Mobile banking services are majorly accessed by

student and employed people.

• The major user of mobile banking come under

age group of below 25 years age and majority of

them are student community.

• It is observed that, majority of the customers are

using mobile banking services of ICICI bank for

the purpose of money transfer.

• Majority of the customers have preferred

mobile banking services because it is easy and

convenient to use.

• It is observed that, majority of the customers

are aware about service cost charges in mobile

banking services.

• The service cost charged by the bank on mobile

banking services is affordable when compared to

other services of the bank.

• Some of the customers are not accessing mobile

banking because of insecurity and difcult

to understand and difculty in using mobile

banking services are the major problem.

• Customers opined that ICICI mobile banking

service is satisfactory.

• Mobile banking is one of the time saving

technology services.

• People are interested to take services of private

sector because it gives good quality of service,

good technology used, they are trust lenders etc.

• Customers are interested to open saving bank

account because mobile banking and various

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

17

modern banking services are available only for

saving bank account holders.

• Among various modern banking services,

majority of the customers prefer to use mobile

banking and ATM because it is very convenient

and easy for operation when compared to other

services.

• The main purpose of using mobile banking is for

money transfer and online purchasing.

• Mobile banking is very simple and convenient to

use so now a days almost all the customers are

using this service for the nancial transactions.

• Mobile banking is regularly used by the

customers for the purpose of checking bank

balance, transfer fund and to know debit and

credit information about the account.

• Some customers are not using this service

because of security issues.

• In the study area it is found that majority of

respondents are satised with the mobile banking

services provided by ICICI bank.

Suggestions

• ICICI bank must keep a frequent touch with

its customers after providing a technological

services to its customers they should improve

their customers relationship management policy.

• Bank has to create a trust in the mind of customers

about security of their accounts

• Bank should reduce the service cost and need to

improve mobile banking service.

• Illiterate people cannot understand mobile

banking service instructions. So, there is a need

to simplify it and instructions should be given in

regional language.

• The technical services of the ICICI bank must

be improved.

• Give proper training to customers for using

mobile and for other modern banking services.

• Illiterate people can’t able to understand and

operate mobile banking services. So bank has to

conduct some programs toward the operation of

Mobile banking services.

• Bank need to simplify less procedure for

accessibility of mobile banking.

• Bank should increase the service of mobile

banking.

• Bank should give clear information to the

customers about charging of service cost.

• ICICI bank should make the procedure for

transaction simple and easy.

• Awareness about various services available

through the mobile banking should be created.

• Transaction cost charged on mobile banking

should be regularly communicated to customer.

• ICICI Bank is charging more charges towards

internet banking facility so if they reduce the

hidden charges or any charges it is benecial for

more customers to utilize this facility.

• ICICI Bank has to improve the service of time

given for transaction to users.

Conclusion

ICICI bank is providing very good services and

they are maintaining the good relationship between

the customers, they are also providing modern

banking facilities like cards, these are modern

banking facilities helps the customer to make easy

transaction. E-banking, EFT, ATMs, Mobile banking

and internet banking, Electronic Clearing Services

[ECS], credit

In this study, it came to know that ICICI bank

is providing good mobile banking services to its

customers. So here there is an opportunity for ICICI

bank to promote mobile banking services to the

customer. Many people are interested to use mobile

banking services from ICICI bank but some customer

further, with increasing consumer demands, bank

have to constantly think of innovative customized

services to remain competitive. Mobile banking is an

innovative tool that is fast becoming a necessity. It

is a successful strategic weapon for banks to remain

protable in a volatile and competitive marketplace

of today.

References

Devadevan, “A study on Mobile banking in India -

Issues and challenges”.

Federal Reserve BANK; “Consumer and mobile

nancial services: A survey”, March, 2012

(www.federaleserve.gov)

International Journal of Emerging Technology and

Advanced Engineering, ISSN: 2250-2459,

Volume 3, Issue 6, June 2013.

Shanlax

International Journal of Commerce

http://www.shanlaxjournals.in

18

Jadav Anil, “Study on Status of E-banking in India.”,

2004.

Jonathan Donner, “Study on Mobile Banking and

Economic Development: linking adoption,

impact, and use.”

Jothi, M, “3G Network technology; A back bone

for mobile phone application”, Journal of

commerce and management Thought, vol,1,

no 4, oct-dec 2010, pp.427.

Kamini shah, Sandip Bhat and Jain Nirmal;

“Awareness and perception of consumer

about Mobile banking”, The Indian Journal

of Commerce, vol. 4, no. 1, January-March,

2011.

Krassie Petrova, “A study on Mobile Banking

background, services and adoption.”

Nitin Nayak, Vikas Nath, Nancy Goel. A study of

Adoption behavior of mobile banking services

by Indian consumers”.

Rahamathsana, Hema Date, Abdullah Kammani,

and ‘Niserhundewale’. Study on Technology

adoption and Indian consumers: study on

mobile banking.”

Ranjuchaandran, A study on “Pros and cons of

Mobile Banking”.

Ruby shukla “Pankajshukla: Mobile banking:

problems and prospects.”

Sunil, kumar Mishra and Durga Prasad sahoo, a

study on “Mobile Banking adoption on and

Benet towards customer’s service.”

Tiwari. and Stephen, Buse: “The mobile commerce

prospects: A strategic analysis of opportunities

in the banking sector”, 2007

Vanisree, D. “Study on Mobile Banking in India:

Barriers in adoption and service preferences.”

Vishal Goyal, U. S. “Pandey: Mobile Banking in

India: Practices, Challenges and Security

Issues.”

Web Sources

https://books.google.co.in>books

https://dl.acm.org.>citation

https://en.m.wikipedia.org>wiki>ICICI-Bank

https://en.m.wikipedia.org>wiki>mobile-banking

https://www.icicibank.com

www.academia.edu>MOBILE-BANKING

Author Details

H.Manjula Bai

Faculty Member, Department of Post Graduate Studies and Research in Commerce, Kuvempu University, Shankaragatta,

Karnataka, India. Email ID: [email protected]