International Journal of Scientific Research and Management (IJSRM)

||Volume||5||Issue||07||Pages||6014-6018||2017||

Website: www.ijsrm.in ISSN (e): 2321-3418

Index Copernicus value (2015): 57.47 DOI: 10.18535/ijsrm/v5i7.26

Dr.G.Sasikumar, IJSRM Volume 5 Issue 07 July 2017 [www.ijsrm.in] Page

6014

Mobile Banking and Security Challenges

Dr.G.Sasikumar

Asst.Professor,

PG Department of Economics and Management Studies,

Maruthupandiar College of Arts & Science,

Vallam, Thanjavur, Tamilnadu,

Abstract: Banking services have expanded from cash in the bank to internet banking and now mobile banking which attained broad

recognition internationally. With help of mobile banking facilitates the customers access their accounts and entire information about

bank products and services anywhere anytime through Internet and World Wide Web. The mobile banking is trustworthy, secured and cost

effective, nevertheless complex and vulnerable to network problem. Security issues are significant since intruders makes others life as

unsafe and miserable. One could be sufferer of a cyber crime in several ways. In this paper an effort is made to study the various security

issue, challenges and solutions related to mobile banking services.

Keywords: Mobile phones, Mobile banking, Cyber crime, Internet, Security.

1. Introduction

Banking services have been a division of society for long a

period. The conventional banking services need physical

interactions between customers and banks. Though, mobile

technology has brought banking services to next level. In

recent years, more number of people using banking services

and also modern mobile banking services. Mobile banking is

one of the gifts to human beings by Information and

Communication Technology. The term mobile banking refers

to the use of mobile device to access bank account and

perform online banking tasks such as checking balances,

transferring funds, bill payments etc [11]. Mobile usage has

observed an explosive growth in most of the Asian Economies

like India, China and Korea. In fact Korea possesses about a

70% mobile penetration rate and with its technical study

population has seen one of the most aggressive rollouts of

mobile banking services. Still, the main reason that mobile

banking scores over internet banking is that it enables

access computer

terminal to access their banks, they can now do so on the go

when they are waiting for their bus to work, when they are

travelling or when they are waiting for their orders to come

through in a restaurant. Globally, banks offer a variety of

mobile banking services; and those banks that do not currently

provide m-banking services claim they plan to do so in the

near future to remain relevant, according to a recent survey

conducted by the Aite Group. According to a study from the

University of Hamburg, Germany, m-banking mobile applica-

tions are growing exponentially; roughly 69% of banks already

offer such services.

A major challenge for the adoption of mobile banking

technology and services is the perception of insecurity. In the

survey conducted by the Federal Reserve, 48% of respondents

study, respondents were asked to rate the security of mobile

banking for protecting their personal information and 32%

rated it as somewhat unsafe and very unsafe, while 34% were

not sure of the security. These statistics represent a significant

barrier to the use of mobile banking products and services.

In this paper mobile banking services, challenges in mobile

banking, cyber crime and solutions are analyzed. The rest of

this paper is organized as follows. Section 2 offers literature

review of mobile banking, section 3 explains about the role of

mobile phones in daily routine life and mobile banking

services, section 4 presents the cyber crime problems with

mobile banking. The importance of mobile banking security

and preventive measures for mobile banking are illustrated in

section 5 and section 6 concludes this paper.

2. Literature Review

The Internet is one of the biggest blessings to manhuman

society by technology. One just cannot imagine the life

without the internet. Everyone wants to stay connected with

the Internet all the time through the mobile phones easily. The

mobile phones let users enjoy the social media on the go. A

major part of modern world is addicted to social networking

sites. The growth of every economy depends on various

sectors like agriculture, manufacturing, education, technology,

finance etc. Emerging and fast growing innovations in

information technology and globalization have changed the

whole process of service providing organizations. Innovative

information technology is the backbone of economic

development of any country. Globalization, competitive

pressure, and technology advancement change the whole

process of banking industry.

Now a days, the information and communications technology

have undergone through rapid development. In addition to that

the revolution of wireless technology and the intensive

penetration of mobile phones have encouraged banking

industries around the world and to invest considerably large

budget on building mobile banking systems, through the

adaption of different kinds of strategies with the aim of

attracting customer intention to use this new technology [19],

[21]. Consequently, the most popular banking systems that can

DOI: 10.18535/ijsrm/v5i7.26

Dr.G.Sasikumar, IJSRM Volume 5 Issue 07 July 2017 [www.ijsrm.in] Page 6015

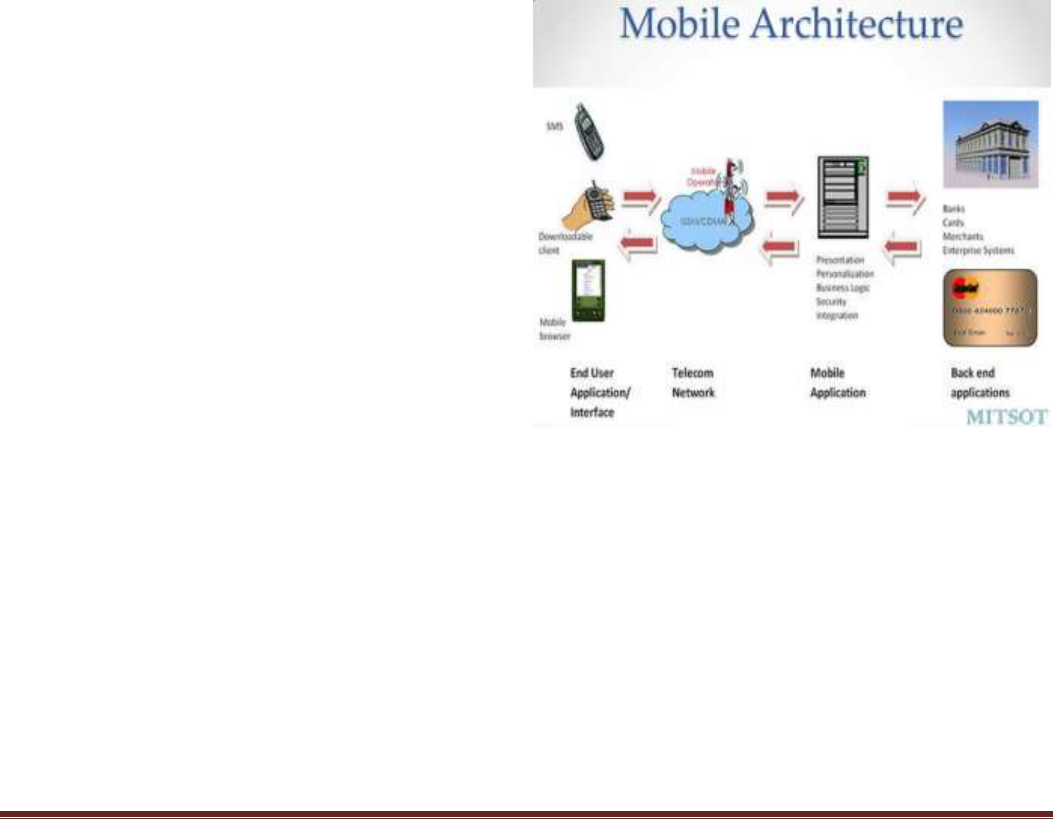

Figure 1: Mobile Banking Architecture

be offered to customers are internet banking and mobile

banking systems, which allow customers to perform their

banking transactions [20]. Garrett has indicated that mobile

banking is the present and future need, paralley security is a

major issue [9]. Vaithilingam, Nair and Guru have investigated

that the adoption of mobile services in Malaysia and found

trust and security has a significant impact on the adoption of

mobile banking [15].

Amit Shankar and Pooja Kumari have been carried out to

know major factors which affecting mobile banking adoption

behaviour in different context. Secondly, quantitative

investigation is provided to support stated hypothesis.

Thereafter, results of reliability and validity test of constructs

are provided [22]. Sultan Y. As-Sultan, Ibrahim Ahmed Al-

have conducted study to

analyze the most well-known and accepted models to provide

a comprehensive understanding of their impacts toward the

adoption of mobile banking applications. In addition to that

the study exploring the most effective factors that have been

used to influence the goal of adoption behavior of mobile

banking applications and suggested some recommendations

for security of mobile banking[23].

3. Mobile Banking

3.1 Role of Mobile Phone

Mobile phones are playing vital role in daily walk of life of

large percentage of the world population. Communication

technology has left no aspect of human life untouched. Even

our morning alarm clocks have been replaced by the mobile

phones. Mobile phones have become a necessity for many

people throughout the world. The ability to keep in touch with

family, business associates, and access to email are only a few

of the reasons for the increasing importance of mobile phones.

Today's technically advanced cell phones are capable of not

only receiving and placing phone calls, but storing data, taking

pictures, and can even be used as walkie talkies, to name just a

few of the available options.

The enlarged uses of smart phones has increased demand for

m-banking services, prompting many more banks,

microfinance institutions, software houses, and service

providers to offer this innovative service together with new

sets of products and applications designed to extend their

client reach, improve customer retention, enhance operational

efficiency, increase market share, and provide new

employment opportunities[14]. Large types of mobile phones

and different operating systems are also a big challenge for

banks, as it is very difficult for them to provide standardized

applications. Convenience and security are two main factors

which can motivate other non-user to use technology based

banking services [5].

3.2 Importance of Mobile Banking

Mobile banking is the latest and most innovative service

offered by the banks. Mobile Banking is considered as a

mechanism which allows customer of a financial institution to

carry out various financial transactions with the help of their

mobile devices, such as Smart phones, notebooks or tablets.

With the increasing use of smart phone mobile banking is

catching up with the common customer [14]. Mobile

connectivity is vast and this makes mobile banking very

successful. The clients access their mobile banking facility

from a browser or a special application, enabling to view their

account balance, send remittances and perform most other

functions also available in standard e-banking facility. Many

experts say that mobile banking offers many benefits worth

using, and some are getting increasingly better. Information

technology has been exercised under two different paths in

banking. One is communication and connectivity and other is

business process [3], [7].

At present, banks have received wireless and mobile

technology into their assembly room to offer their customers

the freedom to pay bills, planning payments while stuck in

traffic jams, to receive updates on the various marketing

efforts while present at a party to provide more personal and

intimate relationships. Mobile devices are integrated with

multiple wireless communication technologies such as

Wireless Fidelity(Wi-Fi), Worldwide Interoperability for

Microwave Access (WiMAX), Bluetooth, Near Field

Communications (NFC), and a cellular interface which are

configured to use CDMA or GSM network schemes[7], [8].

Mobile banking functionality can be divided into three main

areas such as

(i) Informational Functions,

(ii) Transactional Functions and

(iii) Service, Marketing and Acquisition [17].

Owing to growth of Information and Communication

Technology the unethical hackers and anti-social elements are

interested to penetrate the online payments and money

transfer. The confidential information such as user name and

password must be maintained in secured manner to avoid

vulnerable and threats. Most of the banks try to make their

sites secured by implementing latest network security

software. The eminence of online banking services has

become a major region of attention among researchers and

bank managers owing to its strong impact on business

performance, profitability and customer service delivery.

DOI: 10.18535/ijsrm/v5i7.26

Dr.G.Sasikumar, IJSRM Volume 5 Issue 07 July 2017 [www.ijsrm.in] Page 6016

Figure 2: Mobile Banking Apps

Mobile Banking Service include:-

i). Mini statement.

ii). Monitoring of Term deposits.

iii). Ordering Cheque books.

iv). Balance checking in the account

v). Change of Pin.

vi). Blocking the lost ATM card.

vii). Fund Transfer.

viii). DTH Recharging.

ix). Purchasing ticket for a movie or travelling.

Mobile banking services are being offered through many

channels such as Short Messaging Services (SMS), Interactive

Voice Response (IVR), Mobile Application, and Wireless

Application Protocol (WAP), etc. Banks are taking advantages

of mobile innovation to provide its services to customers

economically and profitably. The introduction of m-banking

helps banks to perform its activity efficiently which lead to

consumer satisfaction and loyalty [3], [7].

3.3. Development of Mobile Banking Apps

Mobile banking apps has a short development history. Most

mobile banking service was offered over SMS banking up to

2010. Since 2010, with the success of iPhone and lightning

growth of Google Android, more banks started adapting a new

trend by launching mobile web based service and mobile

banking apps. According to a mini study by Mapa Research in

2012, upon a third of banks have their mobile detection on

their main site. Among the result, 61 percent of the mobile

optimized website has an option to download mobile banking

apps. Mobile banking apps is specifically designed for smart

phone and tablet, which run on OS.

Mobile banking apps is able to download from application

stores. Similar to online banking, mobile banking apps connect

connection, including Wi-Fi, 3G or data transfer, for complete

banking functionality[10]. When mobile phones turned into

smartphone, and began to mimic the power found in most

computers, banks have been able to provide consumers with

powerful mobile banking apps that allow customers to

complete their banking from wherever you are. This includes

making deposits, depending on the bank and its mobile app

checking funds, making bill payments, transferring or sending

money.

Latest all banks mobile apps launched in 2017.

i). Instant Money Transfer (IMT) Bank of India

ii). Kisan card AXIS BANK

iii). Bank of

Maharashtra

iv). M-Pesa ICICI + Vodafone

v). M-Wallet Canara Bank

vi). State Bank Freedom App State Bank of India

vii). Student Travel Card ICICI

viii). TAB BANKING FACILITY SBI

ix). Tap and pay ICICI

x). Twitter Handle account SBI

xi). Video conferencing Indusuld & federal bank

xii). Youth for India SBI

xiii).

SBI

xiv). IMobile app for windows phone ICICI

xv). ion

with American Express ICICI

xvi). RBL

Bank

xvii). Instant money transfer BOI

xviii). - Kotak

Mahindra Bank (KMB)

xix). - ICICI Bank

xx). anchayat - HDFC Bank

xxi). UPI App That Turns Your Smartphone into a Bank

for Easy Transfers RBI

xxii).

Mobile App State Bank Of India

xxiii).

App ICICI Bank

xxiv). Lakshmi Vilas Bank

Laxmi Vilas Bank

xxv). IMT APP (Instant Money transfer ) Launched By

State Bank Of India

xxvi). Ananya Project launched By Syndicate Bank

3.4. Pros and Cons of Mobile Banking

3.4.1.Pros of Mobile Banking

i). Mobile Banking uses the network of service provider

and it doesn't need internet connection. In a developing

countries like India where there is no internet connection

in the interiors there is the presence of mobile

connectivity.

ii). Mobile Banking is available round the clock 24/7/365

and is easy and convenient mode for many mobile users

in the rural areas.

iii). Mobile Banking is said to be more secured and risk

free than online/internet Banking.

iv). With the help of mobile banking you can pay your

bills, transfer funds, check account balance, review your

recent transaction, block your ATM card etc.

v). Mobile Banking is cost effective and Banks offer this

service at very low cost to the customers.

3.4.2. Cons of Mobile Banking

i). Though the security threat is less than internet banking,

mobile banking has security issues. One of the great

threats to mobile banking is "Smishing" which is similar

DOI: 10.18535/ijsrm/v5i7.26

Dr.G.Sasikumar, IJSRM Volume 5 Issue 07 July 2017 [www.ijsrm.in] Page 6017

to "phishing". In "Smishing" users receives fake

message asking for their Bank details. Many users have

fallen to this trap.

ii). Mobile Banking is not available on all mobile phone.

Some time it requires you to install apps on your phone

to use the Mobile Banking feature which is available on

high end smartphone. If you don't have a smartphone

than the use of Mobile Banking becomes limited.

Transaction like transfer of funds is only available on

high end phones.

iii). Regular use of Mobile Banking may lead to extra

charges levied by the bank for providing the services.

iv). Mobile phones are limited in processing speeds,screen

size and battery life. This act as a barrier in Mobile

Banking.

Like all other technology mobile banking has got it advantage

and disadvantage and up to users and how the users utilize

the technology. However there is no doubt that mobile

banking is take part significant role in every day banking

activities.

4 Cyber Crime

Cyber crime is defined as a combination of crime and

Many countries face difficulties in

addressing issues arising from cyber crimes, because they lack

a concrete definition of computer crimes and how such crimes

differ from traditional crimes[2],[12]. Cyber Crime is a

technique that employs ICT components like computer and

communication equipments etc. to harm the individual, trade,

government and ICT infrastructure. Schell and Martin define

suggested that the cyber-attacks against financial services

institutions are becoming more frequent and more

sophisticated [16], [18].

The weak and rigid authentication provided by signature,

PIN, pass-word and card security code in mobile banking has

numerous flaws and loop-holes [6]. Join Tom Wills, renowned

expert in global mobile trends, for insights into how global

banking institutions can navigate the mobile threat landscape,

including:

i). Emerging external threats to mobile banking and

payments;

ii). How to influence the riskiest wildcard user behaviour;

iii). Anti-fraud solutions and strategies to prevent mobile

attacks and maintain customer trust.

Cyber attacks are classified in to several types [13]. They are

i). User based / against a Persons

ii). Property based cyber crimes

iii). Society based cyber crime

iv). Private Organizations based

v). Government based cyber crime.

5 Mobile Banking Security

Security is the foundation for the development of mobile

banking. Only when the security is fully shielded, the mobile

banking can deal with other traditional banking business

activities. The security and privacy of personal information

remain common concerns for mobile phone users, and many

smartphone users reported taking steps to guard against

possible risks. Even the Reserve Bank of India (RBI) that is

the main body, has been issuing various directions and

recommendations from time to time to strengthen cyber

security of banking operations in India.

5.1. Preventive Measures for Cyber Crime

In order to protect banking transactions from frauds and other

threats, some preventive measures are suggested. They are

i). Make sure with a protection program that gives power

over cookies that forward information back to Web sites.

ii). Bring into play latest anti-virus software, operating

systems, Web browsers and email programs

iii). Place firewall and develop your content off line.

iv). Forward credit card information just to safe and sound

web sites

v). If Web site serves up active content from a database,

consider putting that database behind a second interface

on your firewall, with tighter access rules than the

interface to your server.

vi). Ac

vii). Only use the most up-to-date system version of your

mobile device

viii). If possible, use up-to-date virus protection software and a

personal firewall

ix). Turn on Blue Tooth or enable Internet only when

required.

x). Do turn off the wireless connections when not needed.

xi). Regularly update the cell phone software.

xii). Install latest Anti Virus Software, and keep it updated.

xiii). Use strong passwords to lock your cell phone.

xiv). Never share personal information with stranger

xv). Never store personal banking details in cell phones.

xvi). Be suspicious while entertaining strangers on social

networking website.

xvii). While banking and shopping online, ensure the sites are

https or shttp.

6 Conclusion

Security around the transfer of data through communication

channels is a challenge for developers, they noted, pointing out

that developers are placing too much confidence in secure

end-user behavior and back-end server-side communications.

Even now many customers are uncomfortable with online

banking regarding with security. In addition to that cyber

criminals are trying day by day to find new techniques to avail

unauthorized access to finances of financial institutions,

banking customers.

In developing countries, electronic crime is a serious problem

because there is a lack of training on the subjects to investigate

the electronic crime. Precaution is the only way to maintain

secured transactions in this mobile banking system. There is a

need to bring changes in the Information Technology Act to

make it more effective to fight cyber crime. Mobile banking

services play a significant role in improving customer

satisfaction in high level and it has its own impact on customer

satisfaction.

DOI: 10.18535/ijsrm/v5i7.26

Dr.G.Sasikumar, IJSRM Volume 5 Issue 07 July 2017 [www.ijsrm.in] Page 6018

References

[1] Schell, B. & Mart

rbara: ABC-CLIO, 2004.

[2] Aslan.Y. Global Nature of Computer Crimes and the

Convention on Cyber Security. Ankara Law Review,

Vol. 3 No. 2, 129-142, 2006.

[3] Laukkanen.T.,

Process Management Journal; vol. 13 No. 6, pp. 788-

797, 2007.

[4] Bangens. L., & Soderberg.B, Mobile banking-Financial

services for the unbanked, 2008.

[5] Comninos A, Esselaar S, Ndiwalana A, Stork C

Towards evidence-based ICT policy and regulation m-

banking the un

[6] Edge, M A survey of

signature based methods for financial fraud detection.

Computers & security, 28(6), 381-394, 2009.

[7] Quick.C.

opportunity for ma

[8] Alex.K., Is it finally time for M-Commerce,2010.

[9] Garrett, J., Mobile banking security, Credit Union

Magazine, 24-28. Retrieved from

http://www.creditunionmagazine.com/articles/37367-

mobile-banking-security, 2011.

[10] Mapa Research., How the world's top banks handle

mobile device detection.URL:

http://www.maparesearch.com., 2012

[11] Duggal.P., Mobile Banking and Mobile Law, 2013.

[12] Mayunga.J. Cybercrimes Investigation in Tanzania.

Morogoro: Mzumbe University, 2013.

[13] Raksha Chouhan, Shashikant Pardeshi,

Journal of Engineering, Science And Management

Education (JESME), Quarterly Research Journal of

NITTTR Bhopal, Vol-6, Issue- III, JulySeptember

2013, PP 131-136.

[14] Shaikh.A.A., Mobile banking adoption issues in

Pakistan and challenges ahead. J. Inst. Bankers Pak. 80

(3), 1215, 2013.

[15] Vaithilingam, S., Nair, M., & Guru, B. K. . Do trust and

security matter for the development of M-banking?

Evidence from a developing country. Journal of Asia-

Pacific Business, 14(1), 4-24,2013

[16] Cuomo A. M., Report on Cyber Security in the

Banking Sector. New York State Department of

Financial Services, 2014.

[17] Pegueros.V.,Security of Mobile Payment and Banking.

URL:http://www.sans.org/reading-room/whitepapers

/ecommerce/security-mobile-banking-payments-34062.

Accessed: 12 Dec 2014.

[18] Ryan W. J., A Resource Guide for Bank Executives:

Exec-utive Leadership of Cyber rence

of State Bank Supervisors, 2014.

[19] J. Tellez Isaac and Z. Sherali, "Secure Mobile Payment

Systems," IT Professional, vol. 16, pp. 36-43, 2014.

[20] T.Wai-Ming and L. S. L. Lai, "Mobile Banking and

Payment in China," IT Professional, vol. 16, pp. 22-27,

2014.

[21] A. A. Shaikh and H. Karjaluoto, "Mobile banking

adoption: A literature review," Telematics and

Informatics, vol. 32, pp. 129-142, 2015.

[22] Amit Shankar and Pooja Kumari Factors Affecting

Mobile Banking Adoption Behavior in India Journal

of Internet Banking and Commerce, vol. 21, no. 1.,

2016

[23] Sultan Y. As-Sultan, Ibrahim Ahmed Al-

Journal of Advanced Research in Computer Science

and Software Engineering, Volume 7, Issue 2, February

2017.

Author Profile

Dr.G.SASIKUMAR is working as Assistant Professor in

Economics and Research Advisor in the PG Dept. of

Economics and Management Studies, Maruthupandiar

College of Arts & Science, Vallam, Thanjavur, Tamilnadu,

India. He has completed his M.A. Economics in A.V.V.M.Sri

Pushpam College affiliated to Bharathidasan

University,Trichy, TamilNadu, India in the year 2000 and

M.Phill in Economics in Annamalai University in the year

2002. He has received his Ph.D in

Economics from Bharathidasan

University, Trichy in the year

2010. Also he has finished his

MBA in Finance in Rajah Serfoji

Govt. College affiliated to

Bharathidasan University in the

year 2017.

Honorable Puthucherry Chief

Minister NARAYANASAMY at Puthucherry on 26.03.2017

organized by Top International Educational Trust-TIESFA-

2017. He has 15 years of teaching experience at PG level in

the field of Economics and Management Studies. He has

published two research papers in International Journals and

presented many papers in the National and International

conferences. Also he has published three books with ISBN

Number. His areas of research interest include Finance,

Environmental Economics, Agricultural Economics, and

Microeconomics.