Journal of Service Science and Management, 2019, 12, 649-664

http://www.scirp.org/journal/jssm

ISSN Online: 1940-9907

ISSN Print: 1940-9893

DOI:

10.4236/jssm.2019.125045 Aug. 19, 2019 649 Journal of Service Science

and Management

Service Quality of Mobile Banking Services in

ICICI Bank Limited

R. Ayswarya

1

, D. Sarala

1

, P. Muralidharan

2

, M. Ilankadhir

3

1

PG & Research Department of Commerce, Cauvery College for Women

(Autonomous), Tiruchirappalli, India

2

Department of Commerce, St. Joseph’s College of Commerce (Autonomous), Bangalore, India

3

School of Management Studies, Sathyabama Institute of Science and Technology, Chennai, India

Abstract

Purpose:

Mobile banking is the latest and most innovative service offered by

Banks. The purpose of the study is to investigate the determinants of service

quality of mobile banking services in ICICI.

Methodology: This study was

conducted by using empirical research and Cluster cum Simple random sam-

pling method has been adopted for a sample size of 100 respondents using

mobile banking services in ICICI bank Limited.

Findings: 35 percent of the

respondents are using the SMS mode of mobile banking services. The dimen-

sions of service quality factors of mobile banking services maintained by

ICICI Bank Ltd are Co

nvenience, Responsiveness, Security, Accessibility,

Assurance, Knowing the customer and efficiency mobile banking services.

The factors that satisfy the customers’

level towards mobile banking services

offered by ICICI Bank Ltd. are banking activities, banking products and

other

services. The reasons for using mobile banking services are Convenient ser-

vices, Time-saving and quick service.

Originality/Values:

This paper shows

that the mobile banking service quality dimensions are an important factor to

satisfy the customers. The outcomes of this study enhance the kno

wledge on

the performance of ICICI bank as well as customer satisfaction, which are in-

valuable to all the bank managers and industry players in improving their

services.

Keywords

Customer Satisfaction, Service Quality, Mobile Banking Services

1. Introduction

Currently, mobile banking is a quite widespread banking system in the world.

How to cite this paper:

Ayswarya, R.,

Sarala

, D., Muralidharan, P. and Ilankadhir,

M

. (2019) Service Quality of Mobile Bank-

ing Services in ICICI Bank Limited

.

Journal

of

Service Science and Management

,

12,

649

-664.

https://doi.org/10.4236/jssm.2019.125045

Received:

July 10, 2019

Accepted:

August 16, 2019

Published:

August 19, 2019

Copyright © 201

9 by author(s) and

Scientific

Research Publishing Inc.

This work is licensed under the Creative

Commons Attribution International

License (CC BY

4.0).

http://creativecommons.org/licenses/by/4.0/

Open Access

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 650 Journal of Service Science

and Management

Many banks are started to provide mobile banking services. Mobile banking is a

financial transaction conducted by logging on to the bank’s website by using a

handphone or cell phone [1]. The global smartphone penetration forecast shows

that around 50 percent of mobile users worldwide are projected to own a smart

device as of 2018 [2]. The mobile phone penetration is rounding up to 67 per-

cent in 2019 [3]. 60 percent of customers have used mobile banking this year to

check account balance, view recent transactions, pay bills, transfer funds or

other banking needs. 73 percent made a purchase with a mobile app that can be

used at many different retailers; 64 percent paid an individual through a bank’s

app; 62 percent paid an individual through a payment service’s app. Smart-

phones have become more affordable and the falling mobile data prices have

helped the internet to reach a bigger mass of the country’s huge population. It

indicates that there is an increase in mobile penetration in India. This penetra-

tion helps to implement the mobile banking system effectively and it will help to

bring all sections of people into the banking system.

Mobile banking makes the change in the traditional processing of the bank’s

works. Mobile banking helps them to transfer and do all the activities in the

same place without moving anywhere. Based on the attitude of the customer

there is a change in the behaviour banking process with the help of mobile

banking which is more comfortable. So, the entire bank started to develop their

activities with the help of mobile banking which is effectively used by the cus-

tomers. Mobile Banking has become one of the important factors that have been

effectively used by the consumer, based on this the updating of banks has to be

done to retain and satisfy the customers. Mobile Banking updates their products

then knowledge of the behavioural intention to adopt mobile with the usage for

transfer of amount, funds, credit, debit, etc. So, mobile banking performed be-

tween bankers and its customers in the form of Short Message Service (SMS),

application-based, the mobile internet, etc., for the purpose of attaining higher

levels of customer satisfaction and increased loyalty by providing any time and

any where banking results in reduction of administrative expenses, lesser num-

ber of branches and lower handling charges with service to the customers.

In the present scenario, the banking sector of India is running in a dynamic

challenge concerning both customer base and performance. Service quality is an

indispensable competitive strategy to retain the customer base. Banks are trying

to focus on customer satisfaction by giving them enhanced quality services. [4]

So the study has examined the customer satisfaction and service quality of mo-

bile banking services in ICICI Bank Ltd. The service quality of banking services

has been measured using SERVQUAL (service quality) scale. In the present

banking system, excellence in customer service and service quality is the most

important tool for sustainable business growth.

2. Theoretical Background

This study predicts great Mobile banking potential in Indian banks as Indian

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 651 Journal of Service Science

and Management

banks will aim to target online banking users without regular access to the

internet but are very likely to own mobile devices. This report of Vital Analytics

recommended huge potential of mobile banking in India, as the study found that

checking account balance is the most frequently cited reason by Urban Indian

customers’ for using Mobile Banking. This report has found that 40 million Ur-

ban Indians used their mobile phones to access their bank account balances fol-

lowed by accessing the last three transactions [5]. This research work compared

the Indian public sector and private sector banks in terms of customer satisfac-

tion and to study the variety of service quality using the SERVQUAL model.

This research work uses both the sources of information,

i.e.

primary and sec-

ondary sources and thereafter the SERVQUAL model has been used to identify

the discrepancy in the service delivery system. Finally, the study concludes by

giving some recommendations to improve in the area where these banks do not

meet the expectation of their customers [6]. This paper focuses on adoption and

usage of m-banking services among Indian banking industries as well as cus-

tomers and include the challenges & difficulties of m-banking services like high

charges, slow data transmission and insecurity. Customer is not much aware of

mobile banking in compare with ATM, credit card, debit card, etc. [7]. This

study focuses on m-banking performance with the help of special programmed

called clients downloaded to the mobile device. This paper suggests solutions

that have been designed to support multiple channels across the entire customer

life cycle. This study identifies the mindset and analyses the security issues in

Mobile banking among the banking customers in India. Primary data was col-

lected from 65 respondents using an online questionnaire in this study. Secon-

dary data was also used from the website of the Telecom Regulatory Authority of

India (TRAI). The findings indicate that most of the respondents are using

online banking facility from their respective banks. However, around 25 percent

of customers are using Mobile banking and the remaining 75 percent are not [8].

This study examined the adoption and impact of Mobile banking on customers

of different banks located in Delhi. A survey opinion of 200 customers was con-

ducted. ANOVA and Factor Analysis have been used and there were five factors

identified; Security/Privacy, Reliability, Efficiency and Responsiveness on the

basis of understanding of customer’s perception regarding Mobile banking. The

results indicate that demographic factors can have a significant impact on cus-

tomer perception [9]. This study also revealed on factors affecting mobile bank-

ing services—an empirical study on the adoption of mobile banking mode of

services, presently the Internet technology has brought the third revolution to

this world. In this study identifies mobile banking technology which is the third

era of technology of banking sector after phone and net banking and compara-

tively its growth is phenomenal when compared to the first two eras. Even in In-

dia the Mobile Banking is growing fast because of the world’s largest subscriber

base in the mobile sector after China [10]. This study focused on changing con-

sumer behaviour for mobile banking services in India that has been explored

towards the consumer satisfaction of the new electronic payment service as mo-

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 652 Journal of Service Science

and Management

bile banking and the factors influencing the adoption of mobile banking services.

[11]. This study explains technologies in the banking sector have made our life

very easy. This paper is to find out the awareness and level of Satisfaction to-

wards ICICI bank Customers using ATM Service in Coimbatore city. For this

study purpose, primary data were used and 100 respondents were collected in

ICICI. Data were tabulated and analysed with the help of statistical tools to

achieve the objectives of the study [12].

3. Empirical Results

Research Model

Empirical study has been adopted. This study was conducted to assess and

analyse the customer satisfaction and service quality of mobile banking services

in ICICI bank ltd in Tiruchirappalli Town. This empirical study was conducted

using the following methodology.

Statement of the Problem

Mobile banking can play a big role in taking banking services to the remote

area. The competition in the banking sector is increasing rapidly as the number

of players in the industry is increasing. Mobile banking is expected to improve

banks service quality in a form of transactional convenience, saving of time, cost

and quick transaction alert. Realizing the increase in mobile penetration in In-

dia, now banks and other financial institutions are offering various services

through mobile phones. Hence, a research study is required to assess the cus-

tomer satisfaction and service quality of mobile banking service in ICICI bank

Limited to find answers for the following questions.

Are the customers satisfied with the mobile banking services offered by ICICI

bank ltd.?

How is the service quality of mobile banking service maintained in ICICI

bank Ltd.?

What will be the reason for using mobile banking service?

Whether the customers are facing any problems in mobile banking services

offered by ICICI Bank Ltd.?

In order to find out the reasons for the mentioned questions above, the re-

searcher had framed the objectives below.

Objectives of the Study

To assess customer satisfaction towards mobile banking services offered by

ICICI bank Ltd.

To analyse the mobile banking services under the dimensions of service qual-

ity.

To assess the main reasons for using mobile banking services.

Scope of the Study

With the increasing penetration and usage of mobile banking, net banking

and other internet banking facilities, the concerns with regard to safety and se-

curity of online banking transactions have also escalated Bank has advised that

all the users and customers should set-up pin/password for mobile banking, reg-

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 653 Journal of Service Science

and Management

ister/update the mobile number, e-mail ID for instant alerts keep a track of all

banking transactions. Mobile banking as a service has been increasingly accepted

as a medium through which customers may operate their account transactions

anywhere and anytime. This study is confined to the customers within Ti-

ruchirappalli Town. The study will be able to reveal that increase the level of sat-

isfaction of the customers regarding the mobile banking services and the service

quality of the mobile banking in ICICI bank. It also motivates them to use mo-

bile banking services efficiently. It also helps banks to know whether the prod-

ucts or services they are offering are really satisfying the customers’ needs. This

study brings the attention of management towards the importance of training

and development of customers of mobile banking.

Hypothesis

H

0

1

: There is a significant association between Monthly income and the period

of being a customer at ICICI Bank Ltd.

H

0

2

: There is a significant difference between age and respondents often use

mobile banking services.

Data Collection & Tools Used

Both primary and secondary data are used for the study but the analysis was

made mainly using primary data. The data regarding customer satisfaction and

service quality of ICICI Bank Ltd. were collected through the well-structured

questionnaire. The questionnaire was used to collect data from the respondents

who are using mobile banking services in ICICI Bank Ltd. in Tiruchirappalli

Town. The information has been collected from books, journals and websites

from the internet. Percentage analysis, Chi-square, one-way ANOVA and Factor

analysis have been used for the analysis and interpretation. The statistical tools

are used to analyse the data to answer the objective structure.

Sampling Technique

A sample of 100 respondents is approached for the study and analysed. Clus-

ter cum simple random sampling technique is used for the survey. Area of the

study refers to Tiruchirappalli Town, TamilNadu. There are 12 ICICI branches

in Tiruchirappalli Town and the population is 1,167,485 approximately. The re-

searcher has taken only one branch for this study,

i.e.

Thillai Nagar branch.

With the known population, the sample size is determined for the study using

the following formula by Dr. Todd L. Grande.

(

)

( )

2

2

2

2

1

1

1

Zp p

e

n

Zp p

eN

⋅

⋅

−

=

−

+

where

n

= sample size,

z

= confidence level (

z

score value),

e

= margin error,

N

=

population size,

p

= population percent. Hence the sample size is equal to 385.

Form the known population of 1,167,485 with 4 percent margin of error at a

95 percent confidence level with 50 percent population. Therefore, the sample

size is taken for the study is 100.

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 654 Journal of Service Science

and Management

Limitations of the Study

The study is limited to the geographical region of Tiruchirappalli town. Due

to time constraints, the researcher has collected data from 100 respondents only.

4. Results

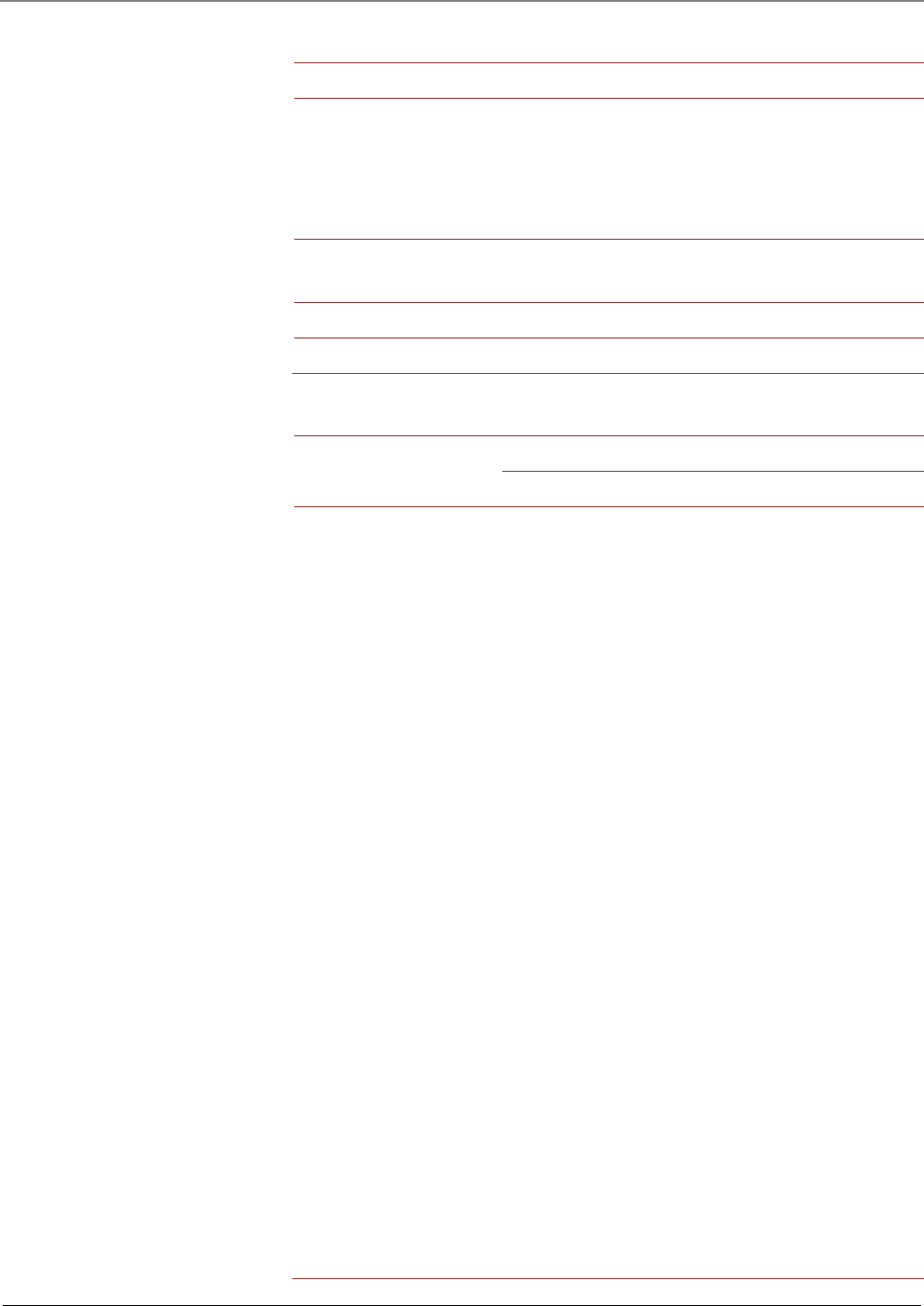

Table 1 showes that out of 100 respondents, It is inferred that majority of the

respondents are in the age group of 21 - 30 years. Majority of the respondents

are female

. Majority of the respondents are postgraduate. Majority of the re-

spondents are doing business. Majority of the respondents are in the Rs. 20,001 -

Rs. 50,000. Majority of the respondents have been a customer for 1 - 5 years.

Majority of the respondents know about the mobile banking services offered by

ICICI Bank Ltd through a customer of the bank. Majority of the respondents are

using SMS banking mode of mobile banking services.

To identify the service quality of mobile banking services in ICICI bank ltd,

the factor analysis technique has been used. The 18 factors are identified namely

Q1, Q2, Q3, ∙∙∙ Q18 was given in

Table 2.

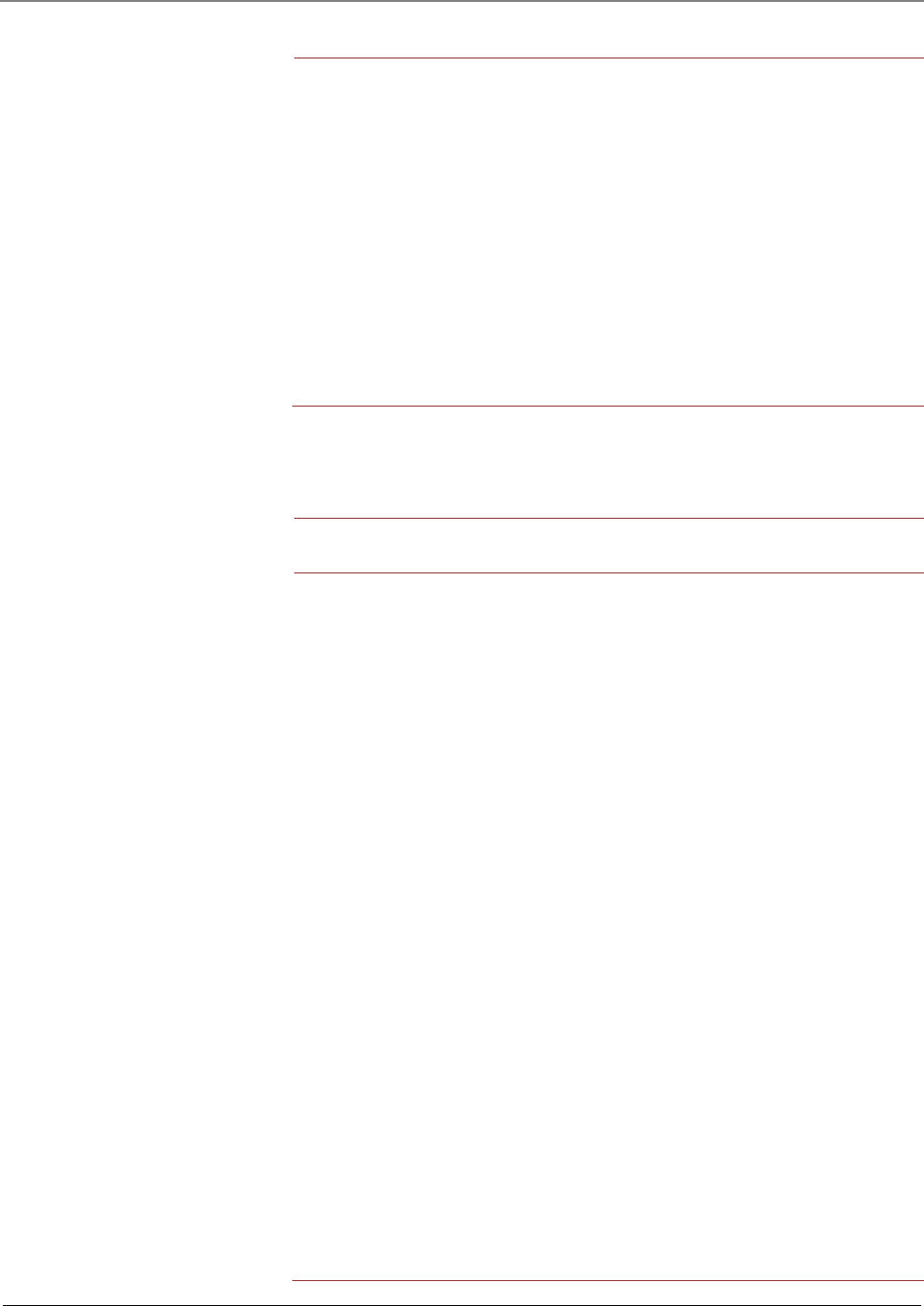

Table 2 reveals that Kaiser-Meyer-Olkin Measure of Sampling Adequacy

(KMO) and Bartlett’s test of sphericity has been applied to the resultant correla-

tion matrix to test whether the relationship among the variables has been sig-

nificant or not as shown in the table. The result of the test shows that with the

significant value of 0.000 there is a significant relationship among the variables

chosen. KMO test has yielded a result of 0.561 which states that service analysis

can be carried out appropriately for these variables that are taken for the study.

Table 3 observes that the reliability of coefficient alpha (

α

) for the 100 cases of

18 items is 0.736 (scale range from 0.0 to 1.0) which shows the reliability of the

given factors.

Table 4 illustrates that the principal component analysis and rotated factors

loading method is used for stimulating factors. It is observed that out of 18 ser-

vices, 7 factors are identified by the rotation method. The total percentage of

variation in the factors shows 67.114 percent.

Table 5 shows that clustering for service quality of mobile banking services in

ICICI bank Limited. It shows that variables 3 qualities Q8, Q13, Q17 are cluster

as factor 1 and is named as “Convenience”. The next 4 variables Q6, Q11, Q14,

and Q18 are cluster as Factor 2 and are named as “Responsiveness”. The next 3

variables Q9, Q10, Q12 are cluster as Factor 3 and are named as “Security”. The

next 3 variables Q1, Q2, Q15 are cluster as Factor 4 and are named as “Accessi-

bility”. The next 2 variables Q4, Q7 are cluster as Factor 5 and are named as

“Assurance”. The next 2 variables Q5, Q16 are cluster as Factor 6 and are named

as “Knowing the Customer”. The next 1 variable Q3 is cluster as Factor 7 and is

named as “Efficiency”.

Hence the factor that stimulates the service quality of mobile banking services

in ICICI bank limited is given below:

1) Convenience;

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 655 Journal of Service Science

and Management

Table 1. Demographic of the respondents.

Factors

Classification

Frequency

Percent

Gender

Male 47 47

Female

53

53

Total 100 100

Age (In Years)

Below 20 years 5 5

21 to 30 years

38

38

31 to 40 years 28 28

41 to 50 years 19 19

Above 51 years 10 10

Total 100 100

Educational Qualification

Under graduate 29 29

Postgraduate

36

36

Professional 19 19

Diploma 13 13

Others 3 3

Total 100 100

Occupation

Professional 18 18

Business

25

25

Government employee 22 22

Private employee 23 23

Others 12 12

Total 100 100

Monthly Income

(In Rupees)

Below Rs. 20000 23 23

Rs. 20,001 - Rs. 50,000

42

42

Rs. 50,001 - Rs. 100,000 25 25

Above Rs. 100,001 10 10

Total 100 100

Period Of Being A

Customer in ICICI Bank Ltd.

Less than 1 years 16 16

1 - 5 years

42

42

6 - 10 years 35 35

Above 10 years 7 7

Total 100 100

Mobile Banking Services

Offered By ICICI Bank Ltd.

Advertisement 27 27

SMS/E-MAILS 27 27

Customer of the bank

30

30

Employees of the bank 12 12

Others 4 4

Total 100 100

Mode of Using Mobile

Banking Service

Wireless application protocol (WAP) 33 33

Unstructured supplementary data (USSD) 8 8

SMS banking

35

35

Application-based SMS/GPRS 24 24

Total 100 100

Source: computed from primary data.

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 656 Journal of Service Science

and Management

Table 2. Service quality of mobile banking services in ICICI bank Ltd.

KMO and Bartlett’s Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. 0.561

Bartlett’s Test of Sphericity

Approx. chi-square 425.553

df 153

Sig. (0.000)**

Table 3. Reliability analysis on service quality.

No. of Cases

No. of Items

Reliability Coefficient Alpha

100 18 0.736

Table 4. Rotated factor loadings on service quality.

Service Quality

Factors

1

2

3

4

5

6

7

Provide relevant &

accurate information-Q1

0.637

Update technology

regularly-Q2

0.771

Maintaining accurate

record-Q3

0.868

The bank is willing to

help customers and provide

prompt service-Q4

0.631

Get Immediate help for

problem or queries-Q5

0.692

Prompt responses to the

requests by SMS/email

or other means-Q6

0.643

Mobile hackers may not take

control of my account-Q7

0.774

Safe to do transactions-Q8

0.697

Secure credit/debit card or

other pin information-Q9

0.547

Save time-Q10

0.762

Information content and texts

are easy to understand-Q11

0.559

Reading characters on

the website is easy-Q12

0.682

Availability of customer

service for 24 * 7-Q13

0.832

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 657 Journal of Service Science

and Management

Continued

Anywhere and

anytime banking-Q14

0.725

Solve the banking

problems quickly-Q15

0.721

Easy to contact

the bank-Q16

0.783

Speed of login to

account is fast-Q17

0.513

Reducing the

waiting time-Q18

0.589

Percentage of Variance 11.124 10.628 10.522 9.764 8.780 8.686 7.609

Cumulative percentage 11.124 21.752 32.774 42.038 50.818 59.505 67.114

Source: primary data. Extraction method: principal Component Analysis.

Table 5. Clustering of stimulating factor in service quality of mobile banking services in

ICICI bank ltd.

Factor

Particulars

Rotated Factor

Loadings

1) Convenience

(11.124 Percent)

Safe to do transactions-Q8 0.697

Availability of customer service for 24 * 7-Q13 0.832

Speed of login to account is fast-Q17 0.513

2) Responsiveness

(10.628 Percent)

Prompt responses to the requests by

SMS/email or other means-Q6

0.643

Information content and texts are easy to

understand-Q11

0.559

Anywhere and anytime banking-Q14 0.725

Reducing the waiting time-Q18 0.589

3) Security (10.522 Percent)

Secure credit/debit card or

other pin information-Q9

0.547

Save time-Q10 0.762

Reading characters on the website is easy-Q12 0.682

4) Accessibility

(9.764 Percent)

Provide relevant & accurate information-Q1 0.637

Update technology regularly-Q2 0.771

Solve the banking problems quickly-Q15 0.721

5) Assurance (8.780 Percent)

The bank is willing to help customers

and provide prompt service-Q4

0.631

Mobile hackers may not take control of

my account-Q7

0.774

6) Knowing the Customer

(8.686 Percent)

Get Immediate help for problem or queries-Q5 0.692

Easy to contact the bank-Q16 0.783

7) Efficiency (7.609 Percent) Maintaining accurate record-Q3 0.868

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 658 Journal of Service Science

and Management

2) Responsiveness;

3) Security;

4) Accessibility;

5) Assurance;

6) Knowing the Customer;

7) Efficiency.

To identify the respondents’ level of satisfaction towards the mobile banking

service in ICICI bank ltd, the factor analysis technique has been used. The 10

factors are identified namely S1, S2, S3, ∙∙∙ S10 was given in

Table 6.

Table 6 reveals that Kaiser-Meyer-Olkin Measure of Sampling Adequacy

(KMO) and Bartlett’s test of sphericity has been applied to the resultant correla-

tion matrix to test whether the relationship among the variables has been sig-

nificant or not as shown in the table. The result of the test shows that with the

significant value of 0.000 there is a significant relationship among the variables

chosen. KMO test has yielded a result of 0.621 which states that service analysis

can be carried out appropriately for these variables that are taken for the study.

Table 7 observes that the reliability of coefficient alpha (

α

) for the 100 cases of

10 items is 0.661 (scale range from 0.0 to 1.0) which shows the reliability of the

given factors.

Table 8 illustrates that the principal component analysis and the rotated fac-

tor loading method is used for stimulating factors. It is observed that out of 10

services, 4 components are identified by the rotation method. The total percent-

age of variation in the factors shows 63.563 percent.

Table 9 shows that clustering of stimulating factor in the level of satisfaction

towards mobile banking services in ICICI bank limited. It shows that variables 4

services Q2, Q3, Q7 and Q9 are cluster as factor 1 and is named as “Banking ac-

tivities”. The next 3 variables Q1, Q5, Q8 are cluster as factor 2 and is named as

“Banking products”. The next 2 variables Q6, Q10 are cluster as factor 3 and is

named as “Other services”. The next 1 variable Q4 is cluster as factor 4 and is

named as “Other services”.

Table 6. Respondents level of satisfaction towards the mobile banking services in ICICI

bank Ltd.

KMO and Bartlett’s Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. 0.621

Bartlett’s Test of Sphericity

Approx. chi-square 161.621

df 45

Sig. (0.000)**

Table 7. Reliability analysis of level of satisfaction.

No of Cases

No of Items

Reliability Coefficient Alpha

100 10 0.661

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 659 Journal of Service Science

and Management

Table 8. Rotated factor loadings on level of satisfaction.

Particulars

Factors

1

2

3

4

Monitoring of term deposits-Q1

0.832

Cards services & Card transfer-Q2

0.718

Fund transfer-Q3

0.546

Payments (Mobile Recharge,

Bills payments & Tax payments)-Q4

0.813

Checking of accounts History and

mini statement-Q5

0.470

Cheque book Request-Q6

0.801

Change of PIN, Provisions-Q7

0.771

Immediate Payment Service (IMPS)-Q8

0.709

Mutual funds statement-Q9

0.630

SMS alter about bank services and

update new product-Q10

0.740

Percentage of Variance 19.724 16.003 14.670 13.166

Cumulative percentage 19.724 35.727 50.397 63.563

Source: primary data. Extraction method: principal component analysis.

Table 9. Clustering of stimulating factor in level of satisfaction towards mobile banking

services in ICICI bank limited.

Factor

Particulars

Rotated Factor Loadings

1) Banking Activities

(19.724 Percent)

Cards services & card transfer-Q2 0.718

Fund transfer-Q3 0.546

Change of PIN, provisions-Q7 0.771

Mutual funds statement-Q9 0.630

2) Banking Products

(16.003 Percent)

Monitoring of term deposits-Q1 0.832

Checking of accounts history

and mini statement-Q5

0.470

Immediate payment service (IMPS)-Q8 0.709

3) Other Services

(14.670 Percent)

Cheque book request-Q6 0.801

SMS alter about bank services

and update new product-Q10

0.740

4) Other Services

(13.166 Percent)

Payments (mobile recharge,

bills payments & tax payments)-Q4

0.813

Hence the factor that stimulates the level of satisfaction towards mobile

banking services in ICICI bank limited is given below:

1) Banking activities;

2) Banking products;

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 660 Journal of Service Science

and Management

3) Other services;

4) Other services.

To identify the reasons for using mobile banking service, the factor analysis

technique has been used. The 7 factors are identified namely F1, F2, F3, ∙∙∙ F7

was given in

Table 10.

Table 10 reveals that Kaiser-Meyer-Olkin Measure of Sampling Adequacy

(KMO) and Bartlett’s test of sphericity has been applied to the resultant correla-

tion matrix to test whether the relationship among the variables has been sig-

nificant or not as shown in the table. The result of the test shows that with the

significant value of 0.000 there is a significant relationship among the variables

chosen. KMO test has yielded a result of 0.639 which states that service analysis

can be carried out appropriately for these variables that are taken for the study.

Table 11 observes that the reliability of coefficient alpha (

α

) for the 100 cases

of 7 items is 0.697 (scale range from 0.0 to 1.0) which shows the reliability of the

given factors.

Table 12 illustrates that the principal component analysis and rotated factors

loading method is used for stimulating factors. It is observed that out of 7 fac-

tors, 3 factors are identified by the rotation method. The total percentage of

variation in the factors shows 68.789 percent.

Table 10. Reasons for using mobile banking services.

KMO and Bartlett’s Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. 0.639

Bartlett’s Test of Sphericity

Approx. chi-square 136.105

df 21

Sig. (0.000)**

Table 11. Reliability analysis on reasons.

No of Cases

No of Items

Reliability Coefficient Alpha

100 7 0.697

Table 12. Rotated factor loadings on reasons.

Reasons

Factors

1 2 3

Immediate-R1

0.766

Time Saving-R2

0.863

Simple Mechanism-R3

0.745

Low Cost-R4

0.845

Fast Responses-R5

0.305

Quick Service-R6

0.949

Convenient Device-R7

0.620

Percentage of Variance 29.940 21.201 17.648

Cumulative Percentage 29.940 51.141 68.789

Source: primary data. Extraction method: principal component analysis.

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 661 Journal of Service Science

and Management

Table 13 shows that clustering of stimulating factor in reasons for using mo-

bile banking services. It reveals that 3 factors are identified as being the maxi-

mum percent variance accounted. The 3 Reasons R3, R4, R7 are cluster as factor

1 and is named as “Convenient service”. The next 3 Reasons R1, R2, R5 are clus-

ter as factor 2 and is named as “Time saving”. The next 1 Reasons R6 are cluster

as factor 3 and is named as “Quick service”.

Hence the reasons for using mobile banking services are given below:

1) Convenient service;

2) Time-saving;

3) Quick services.

Table 14 shows the results of the association between monthly income and

long customers in ICICI Bank Ltd. Hence the chi-square value is significant at

0.001 percent level. Therefore, H

1

alternative hypothesis is accepted and it is

concluded there is a significant association between mobile income and long

customer in ICICI bank ltd.

A one-way ANOVA was done with age as an independent variable and often

used as mobile banking services dependent variable.

Table 15 depicts the age and respondents often use mobile banking services.

The significant at 0.10 percent level since H

1

alternative hypothesis is accepted.

Therefore, it is concluded that there is a significant difference between age and

respondents often use mobile banking services.

Table 13. Clustering of stimulating factor n reasons for using mobile banking services.

Factor

Particulars

Rotated Factor Loadings

1) Convenient Service

(29.940 Percent)

Simple Mechanism-R3 0.745

Low Cost-R4

0.845

Convenient Device-R7 0.620

2) Time Saving (21.201 Percent)

Immediate-R1 0.766

Time Saving-R2 0.863

Fast Responses-R5 0.305

3) Quick Services (17.648 Percent) Quick Service-R6 0.949

Table 14. Respondents monthly income and long customer in ICICI bank Ltd.

Long Customer

in ICICI

Bank Ltd

.

Monthly Income

Total

Below

Rs. 20,000

Rs. 20,001 - Rs. 50,000

RS. 50,001 - RS. 100,000

Above

Rs. 100,001

Less than 1 Years 9 6 1 0 16

1 - 5 Years 5 28 8 1 42

6 - 10 Years 8 8 12 7 35

Above 10 Years 1 0 4 2 7

Total 23 42 25 10 100

Pearson

Chi-Square

39.223

a

Sig. (0.000**)

Source: primary data. **Sig @ 0.001 percent level.

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 662 Journal of Service Science

and Management

Table 15. Age and respondents often use mobile banking services.

Often Using Mobile Banking Services

Mean Square

F

Sig.

Between Groups 1.936 2.590 (0.042*)

Within Groups 0.747

Source: primary data. *Sig at 0.05 percent level.

5. Findings

The majority (38 percent) of the respondents are in the age group of 21 - 30

years. The majority (53 percent) of the respondents are female. The majority (36

percent) of the respondents are postgraduate. The majority (25 percent) of the

respondents are doing business. The majority (42 percent) of the respondents

earn a monthly income Rs. 20,001 - Rs. 50,000. The majority (42 percent) of the

respondents have been a customer for 1 - 5 years. The majority (30 percent) of

the respondents know about the mobile banking services offered by ICICI bank

limited through the customer of the bank. The majority (35 percent) of the re-

spondents are using SMS banking mode of banking services. Convenience, Re-

sponsiveness, Security, Accessibility, Assurance, Knowing the customer and effi-

ciency are the dimensions of service quality factors of mobile banking services

maintained by ICICI Bank Ltd. Banking activities, Banking Products, Other ser-

vices and other services are the factors that satisfy the customers level towards

mobile banking services offered by ICICI Bank Ltd. Convenient services,

Time-saving and quick service are the reasons for using mobile banking services

.

The result of the chi-square is significant at 0.001 percent level. Hence, H

1

alter-

native hypothesis is accepted. Therefore, there is a significant association be-

tween monthly income and long customer in ICICI Bank Ltd. The result of

one-way ANOVA is significant at 0.10 percent level. Hence H

1

alternative hy-

pothesis is accepted. Therefore, there is a significant difference between age and

respondents often use mobile banking services.

6. Conclusion

With the increasing levels of globalization of the Indian banking industry, the

competition in the banking industry has intensified. Nowadays it turns into a

real form of banking is “Anytime and anywhere” banking. Service quality now

acts as a competitive weapon. The present study reveals that the majority of re-

spondents are satisfied with the banking activities, banking products, other ser-

vices, and other services provided by ICICI mobile banking services. The factor

analysis indicates that service quality of mobile banking services in ICICI bank

Ltd convenience, responsiveness, security, accessibility, assurance, knowing the

customer and efficiency are the major factors responsible for customer satisfac-

tion of service quality stood at 67.114 percent regarding the services provided by

ICICI Bank Ltd. Thus based on the percent level of customer satisfaction in

ICICI Bank Ltd has a scope to improve the quality of the mobile banking service

rendered to its customers to ensure their loyalty. To improve the service quality

R. Ayswarya et al.

DOI:

10.4236/jssm.2019.125045 663 Journal of Service Science

and Management

bank can improve the security and reductions in risk through mobile devices are

building the customer trust in mobile banking services. So bank must be careful

about the security issues. Customer support for guiding the mobile banking ap-

plication uses enhances the customer satisfaction and trust in bank and applica-

tions as well. The accessing of mobile banking should be still more convenient

devices needed. Therefore creating awareness to inform the public about the

benefits derived on the mobile banking services product.

7. Scope for Further Research

Further research can be done in bank wise study on service quality dimensions.

The mobile banking adoption and its opportunities and challenges can be ex-

plored. The qualitative research and quantitative research was done to develop

the service quality measurement scale. So that future studies can think of im-

provement of the scale.

Conflicts of Interest

The authors declare no conflicts of interest regarding the publication of this pa-

per.

References

[1] Tugiramasiko, M. (2018) Analysing Factors Affecting Mobile Banking of Commer-

cial Banks in Uganda: Case of Centenary Bank Uganda Limited, Kireka Branch.

Makerere University, Kampala.

http://dspace.mak.ac.ug/bitstream/handle/10570/6931/Tugiramasiko-cobams-mfs.p

df?sequence=1&isAllowed=y

[2] https://www.statista.com/statistics/257048/smartphone-user-penetration-in-india/

[3] https://www.statista.com/statistics/274774/forecast-of-mobile-phone-users-worldwi

de/

[4] Sivesan, S. (2012) Service Quality and Customer Satisfaction: A Case Study-Banking

Sectors in Jaffna District, Sri Lanka.

International Journal of Marketing

,

Financial

Services & Management Research

, 1, 1-9.

[5] Charul, V. (2009) Mobile Banking in India. Perception & Statistics Vital Analytics.

[6] Khatri, P. and Ahua, Y. (2010) Comparative Study of Customer Satisfaction in In-

dian Public Sector and Private Sector Banks.

International Journal of Engineering

and Management Sciences

, 1, 42-50.

[7] Uppal, R. (2011) Mobile Banking in India: An Empirical Analysis. In: Banking with

technology, Udaipur, India, 29-36.

[8] Gamoorthy Avinanya, S.A. (2012) Mobile Banking: An Analysis.

Asian Journal of

Research in Banking and Finance

, 1, 56-66.

[9] Devadevan, V. (2013) Mobile Banking in India: Issues and Challenges.

International

Journal of Emerging Technology and Advanced Engineering

, 3, 516-520.

[10] Shamser, S. (2014) The Impact and Adoption of Mobile Banking in Delhi.

Interna-

tional Research Journal of Business and Management

, 1, 19-31.

[11] Balakrishnan, L. (2016) Factors Affecting Mobile Banking Services: An Empirical

Study.

ISBR Management Journal Research Center

, 1, 23-29.